Key Insights:

- XRP is the only major cryptocurrency profitable for holders who bought between December 2024 and January 2025.

- XRP maintains a 2% year-to-date gain despite losing its January rally highs.

- Data from Glassnode shows that XRP holders in the three to six-month range have at least 11 percent unrealized profits.

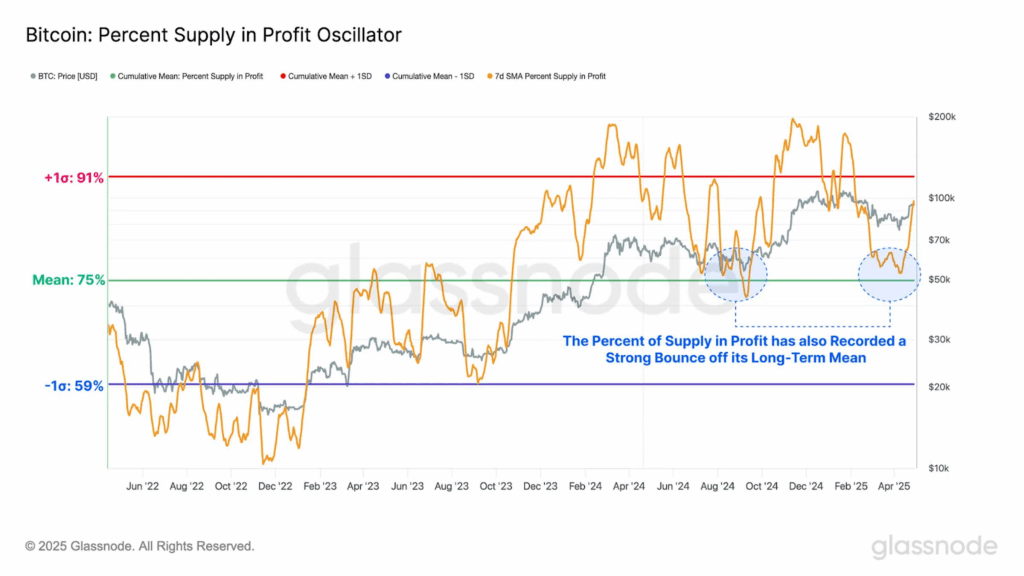

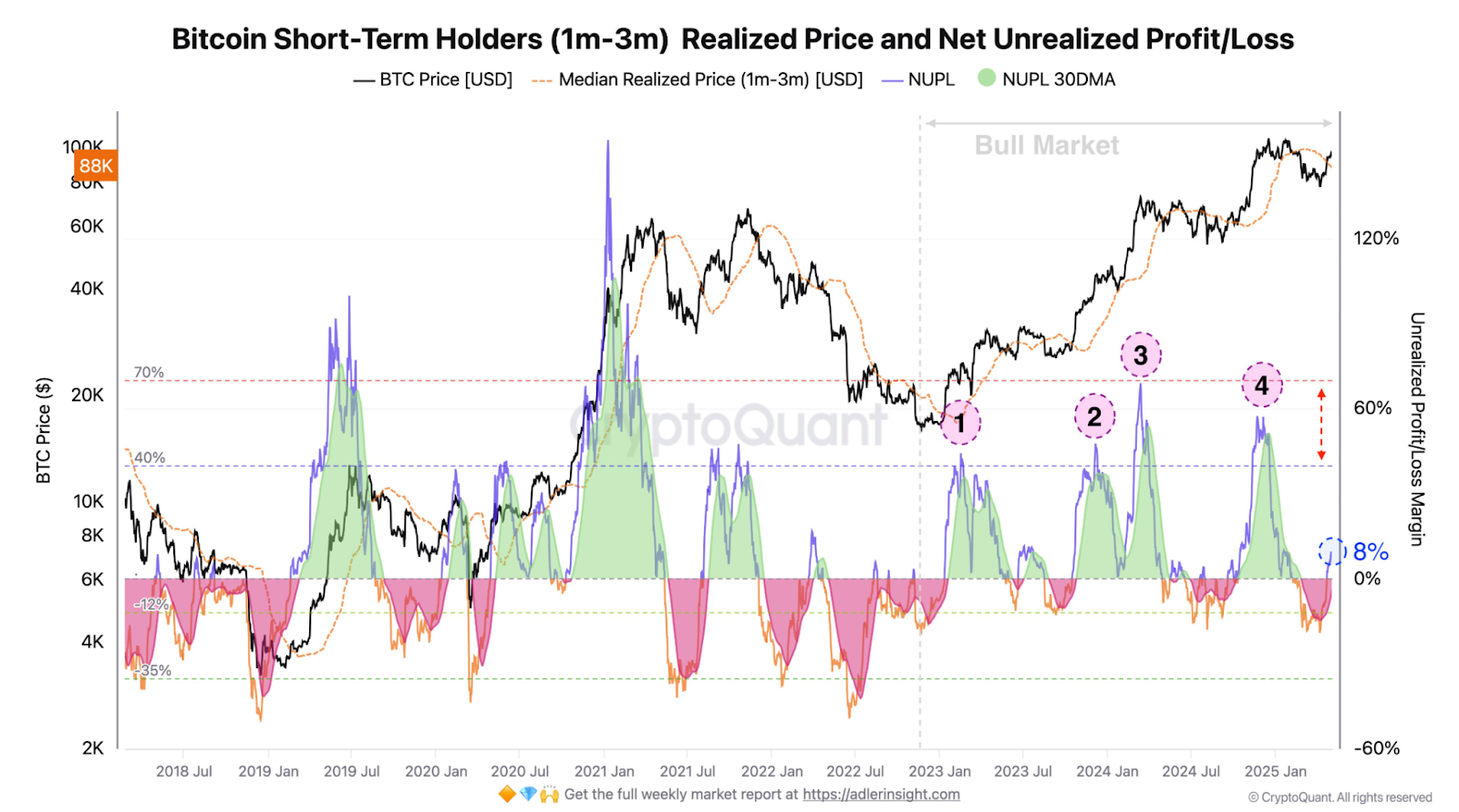

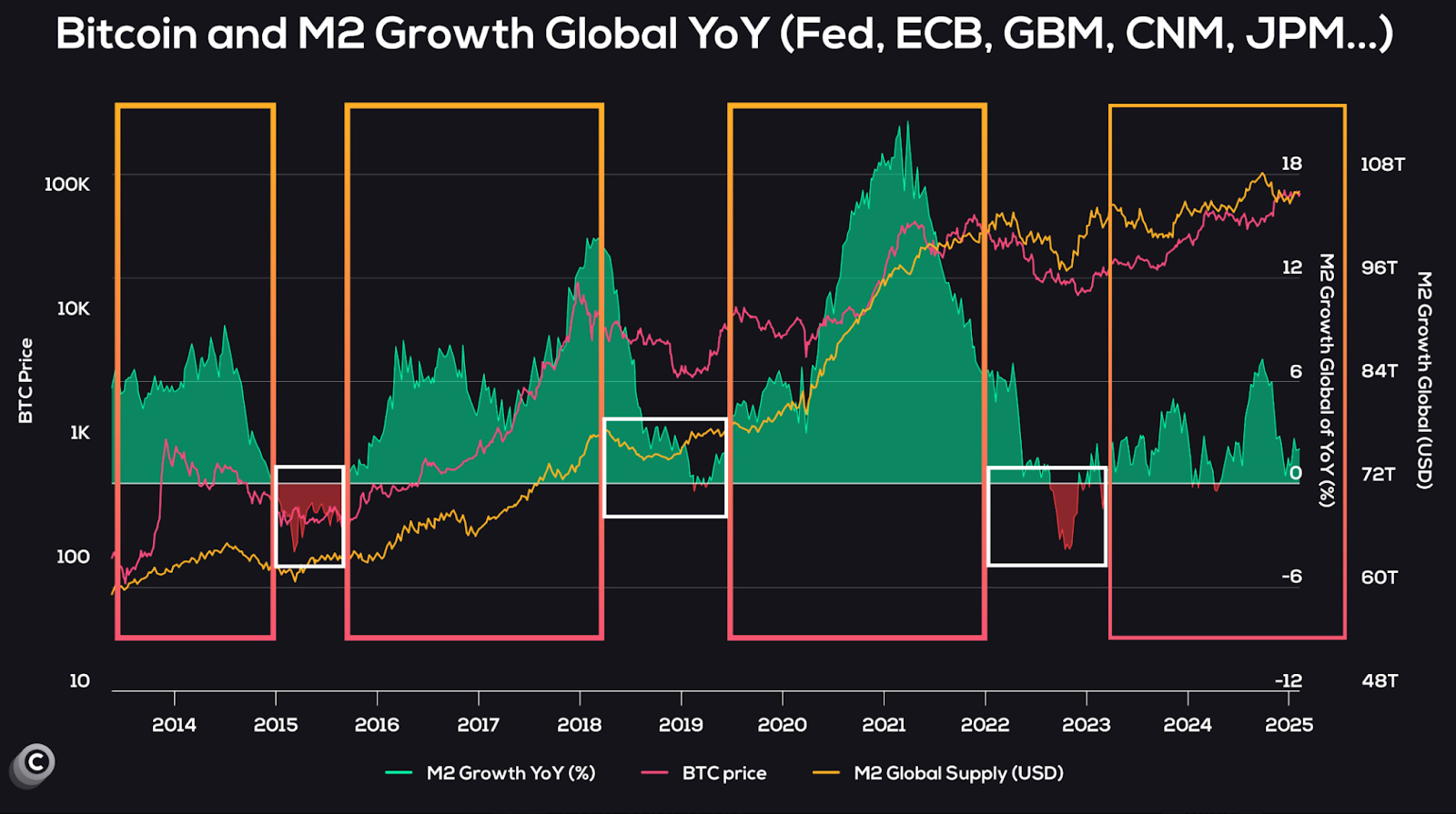

The cryptocurrency market has entered a correction phase as most assets trade below their recent highs. Data shows that only XRP has delivered positive returns to holders who purchased between December 2024 and January 2025. Meanwhile, mid-term holders of Bitcoin, Ethereum, and Solana deal with significant unrealized losses.

XRP Leads as Mid-Term Holders Profit

XRP stands out in a largely declining market, with data confirming profitability for holders within the three—to six-month range.

The asset reached its maximum of $3.399 in January, after which it dropped. However, it is still 2% up this year since it began.

Although it has lost the gains of its January rally, it has protected profitability for the bulls that had previously been seen.

The broader market had a cooldown, but XRP remained stable above its cost basis, at least for recent buyers.

According to Glassnode metrics, the addresses that bought XRP in the bullish wave currently have at least 11% unrealized gains. This strength creates some pressure to sell and flexibility for accumulation.

Furthermore, in the same situations, XRP comes out on top in the data, as the asset boomed among peers.

Even at its current price, which appears to be a retracement, it has commanded a higher average price than buyers’ entries. Hence, XRP provides its owners with more stability amid prevailing market uncertainty.

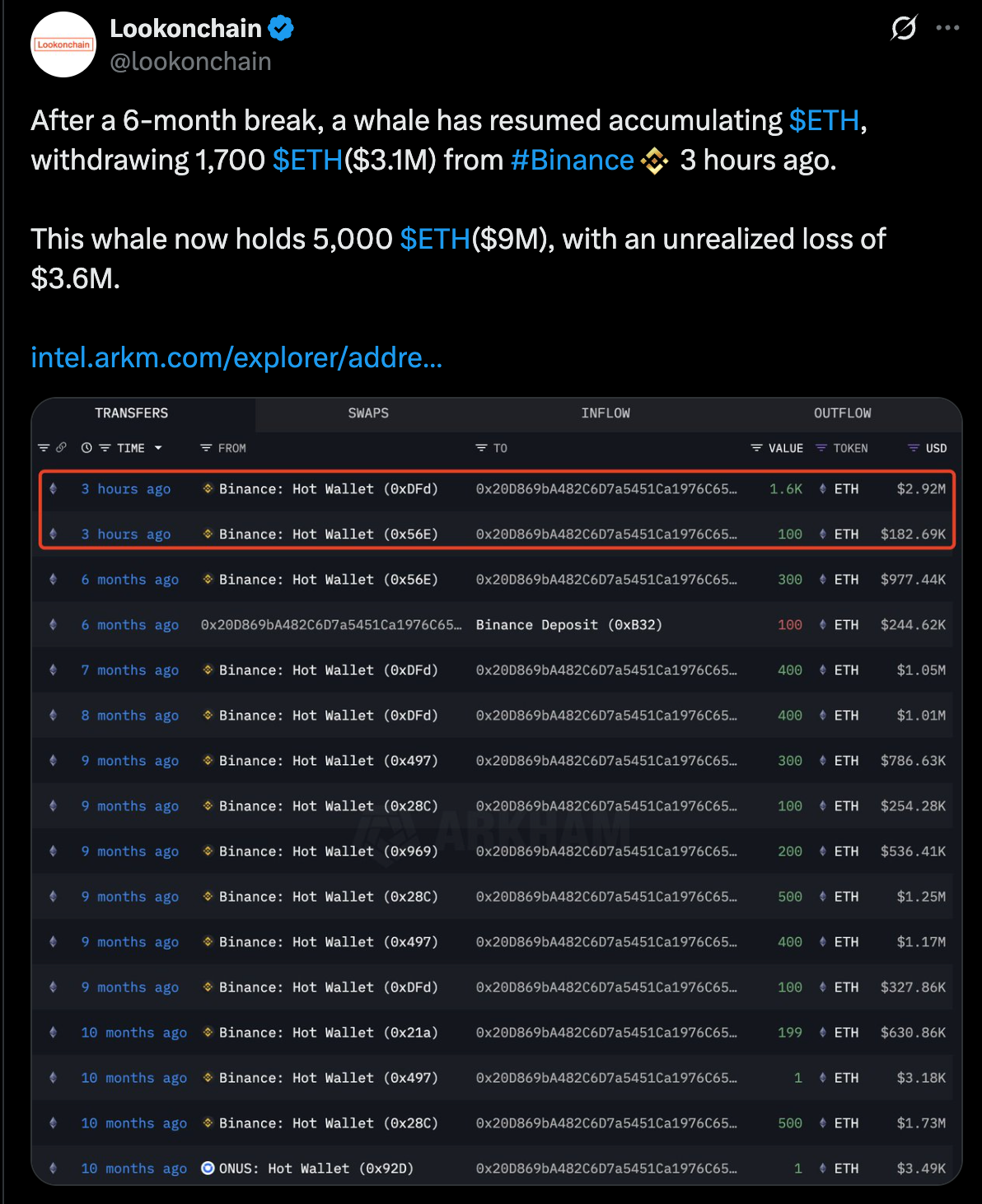

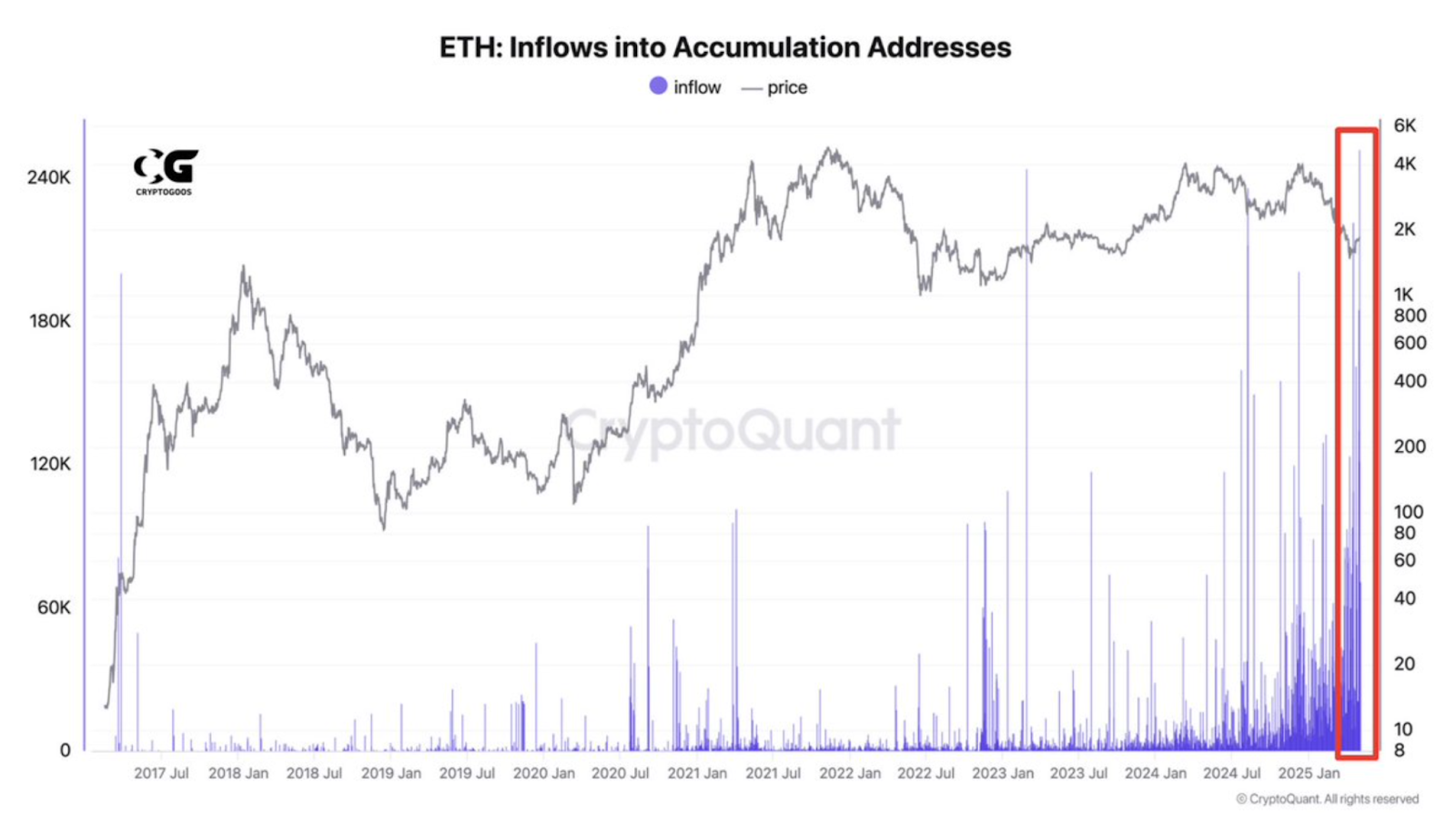

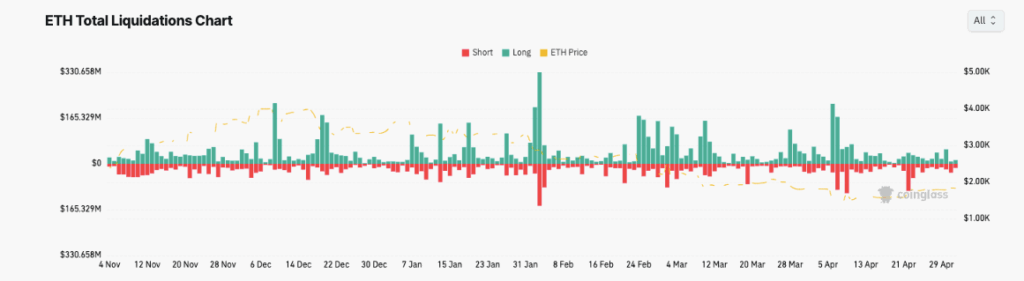

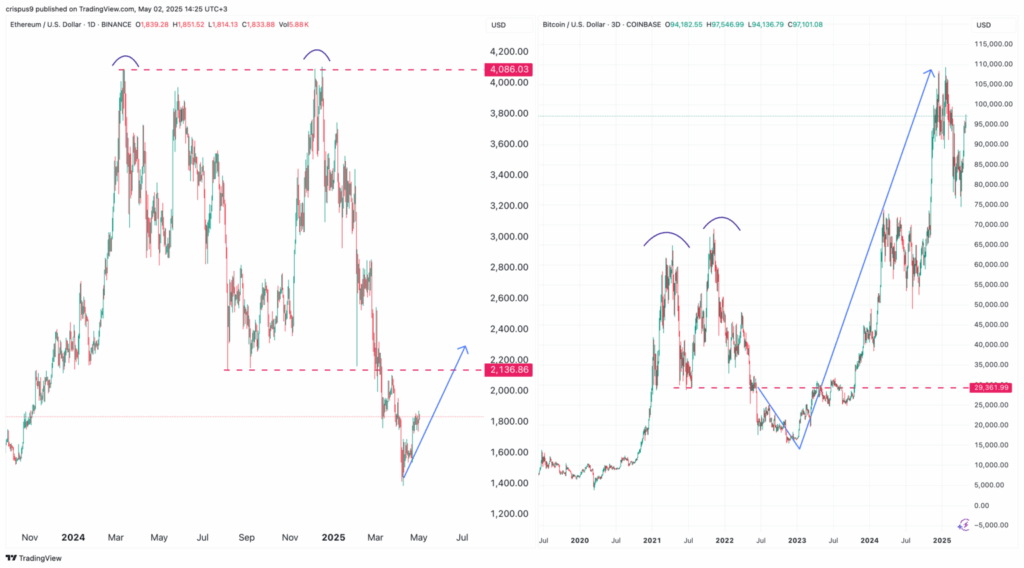

Ethereum Trades Well Below Key Support Levels

Ethereum has experienced its mid-term holders move into the negative, as the current price and entry levels differ by 36%.

The asset oscillates at $1,800, unable to maintain the momentum achieved in the December and January bull runs. This retreat indicates greater troubles brewing with Ethereum’s recent weakness.

While Ethereum’s price action suffers, addresses from December to January come with unrealized losses.

The decline has gone beyond the simple retracement, with recent trends indicating a bearish sentiment that may continue for longer. Therefore, this pressure may also cause more people who entered during the last peak to exit.

Unlike XRP, Ethereum is failing to provide a hook for buyers who got on board when the prices were rising.

Market sentiment is still mixed, but Ethereum demonstrates limited strength as well. As such, the existing range between entry and present prices is still a serious issue for this group of holders.

Solana Sees Sharp Declines in Mid-Term Profitability

Solana has also performed poorly, as evidenced by the significant 28% price decline noted from the mean entry point of mid-term buyers.

The token hit its high earlier in the year and now trades around $146, meaning it is far below the cost from late 2024. This implies a price structure for those who bought in the bullish cycle.

The statistics show that Solana’s market has not grown effectively under the current selling pressure. Mid-term addresses have also become significant paper losses as the asset could not regain key resistance levels. This trend is among many on a long list of vulnerabilities observed in many altcoins.

Also, the mid-term losses indicate low confidence among participants, beginning in December and continuing through January.

Unless there is a recovery, further selling is possible for Solana. The currency’s current state starkly contradicts XRP’s capability of maintaining value under similar market pressure.

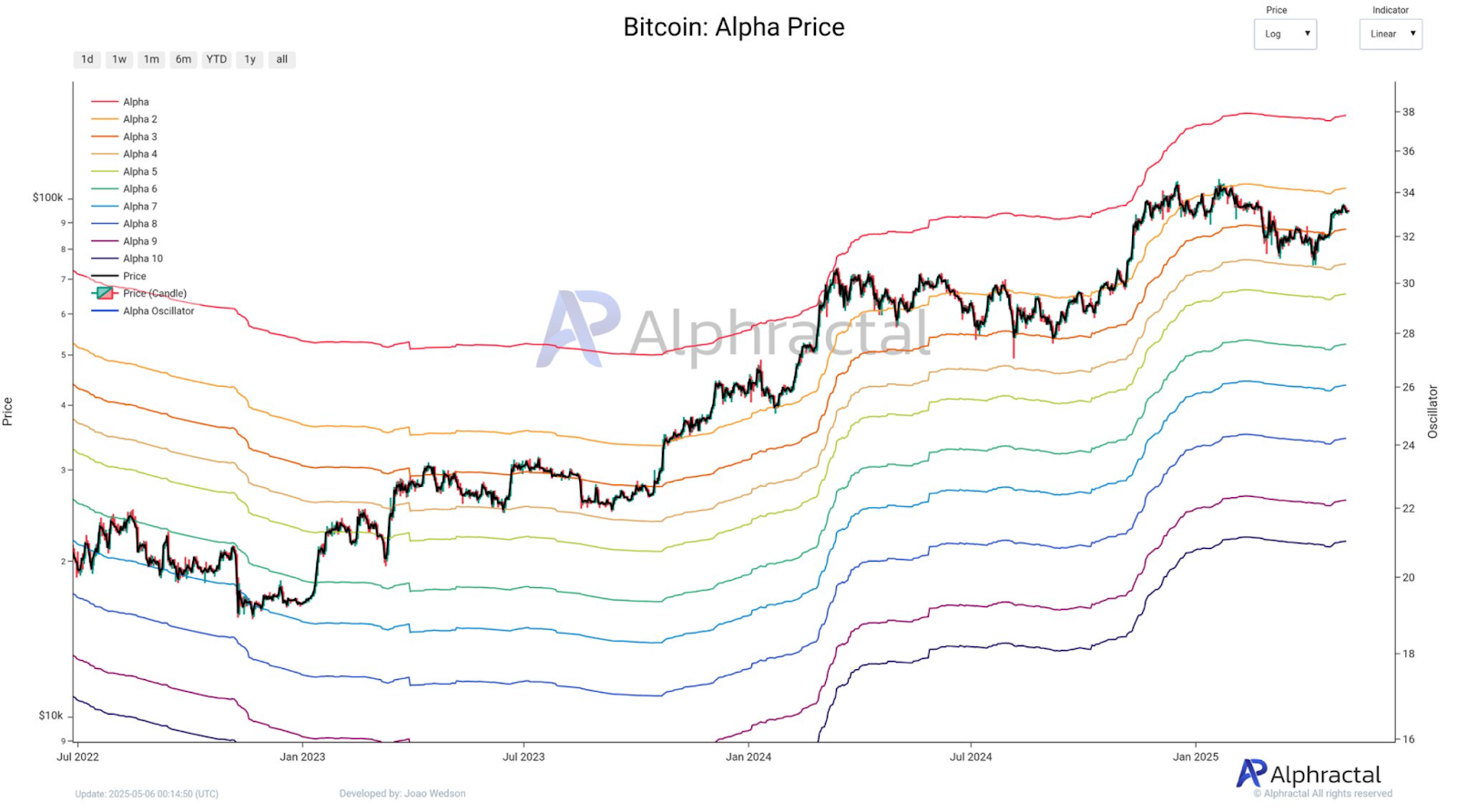

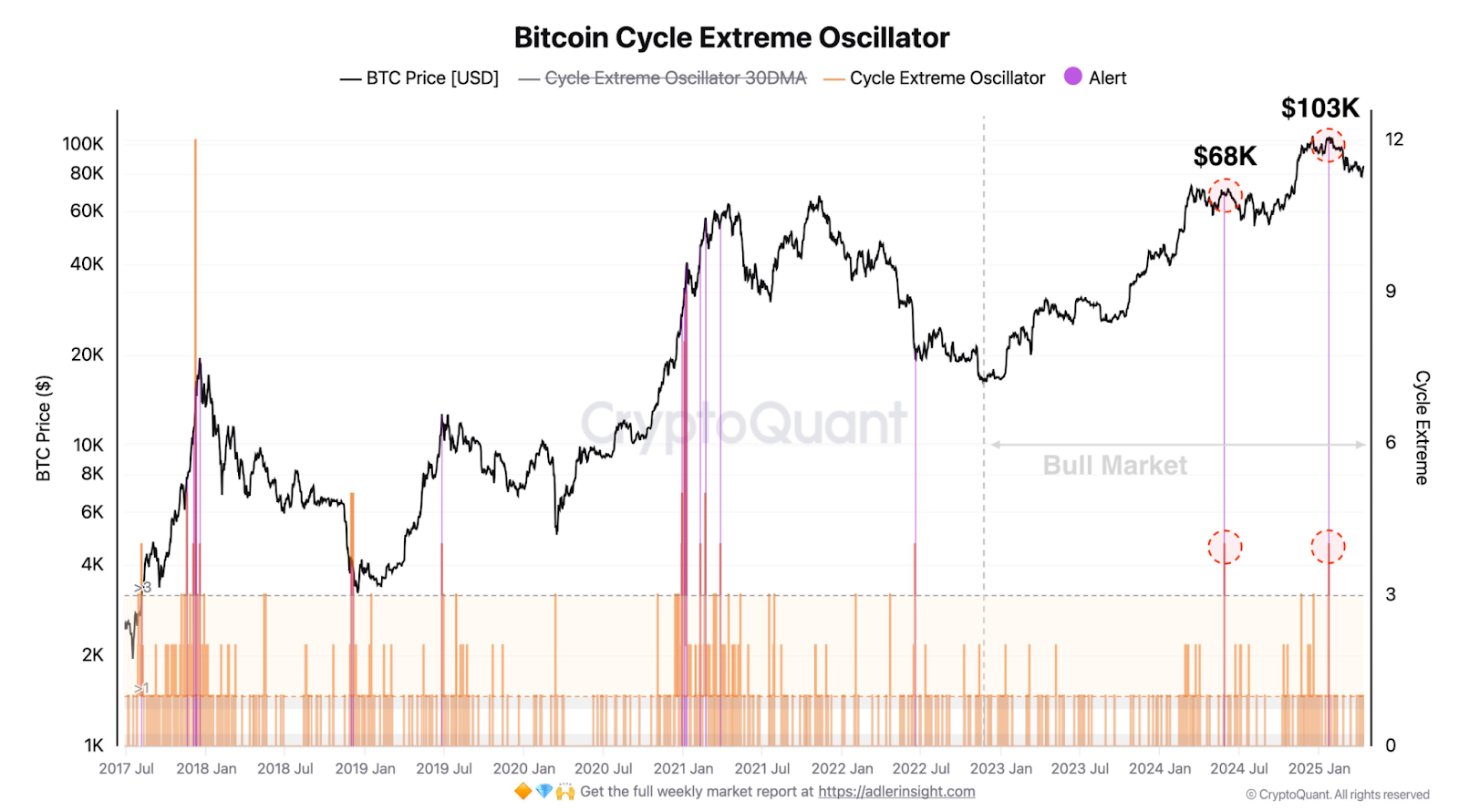

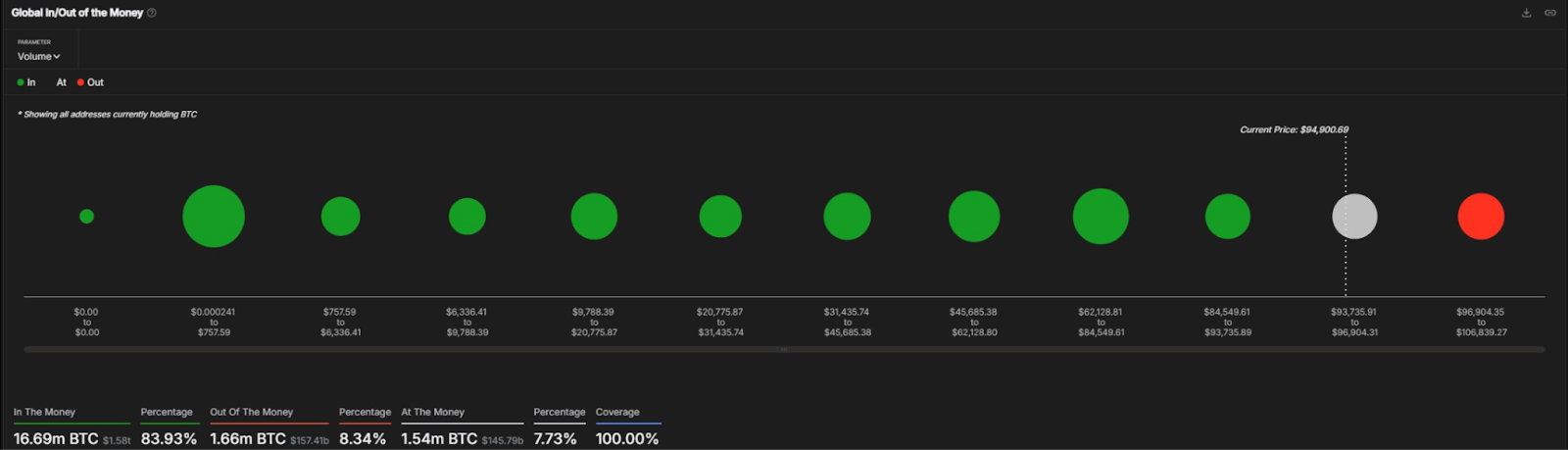

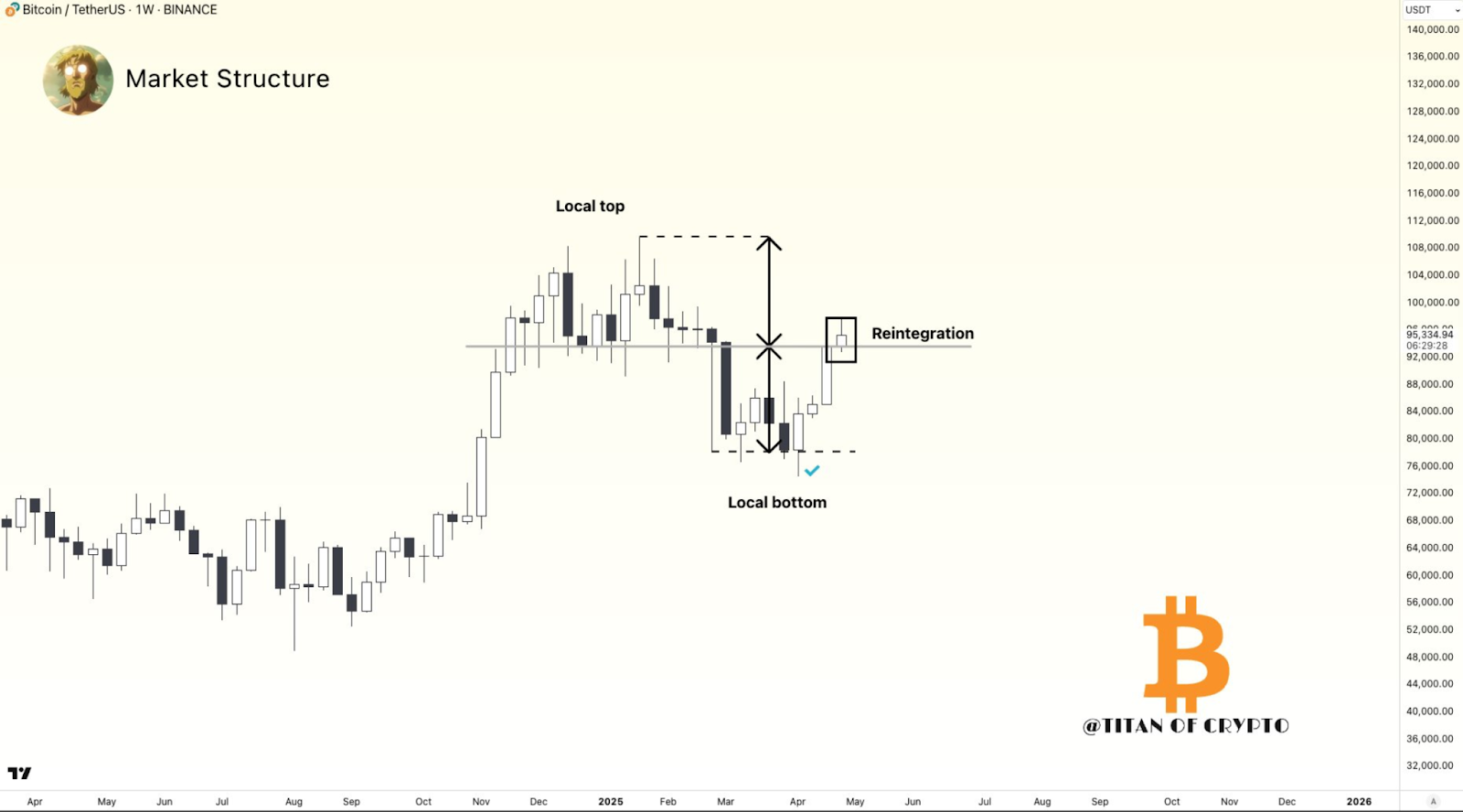

Bitcoin Stays Near Cost Basis but Shows Less Strength

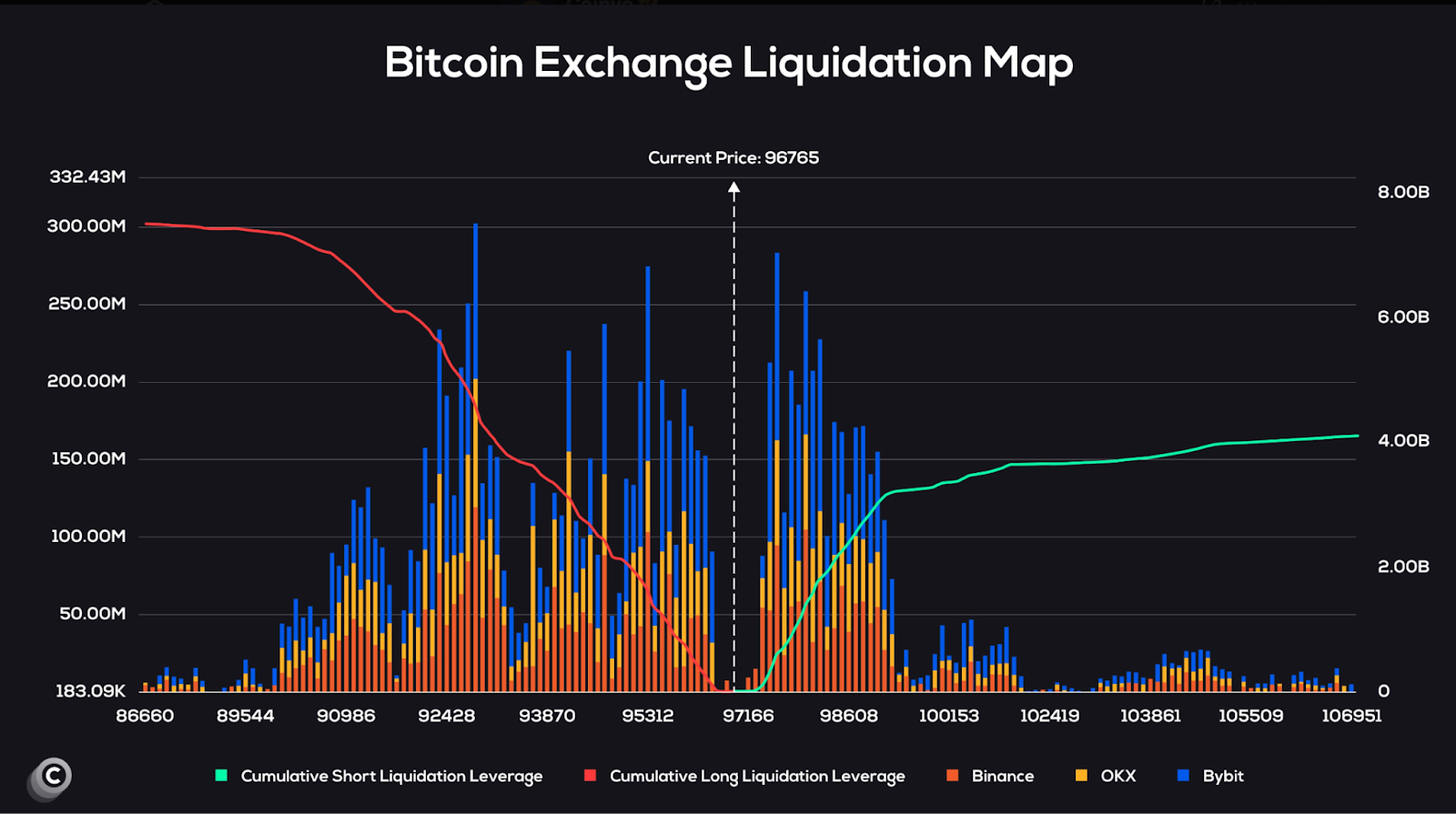

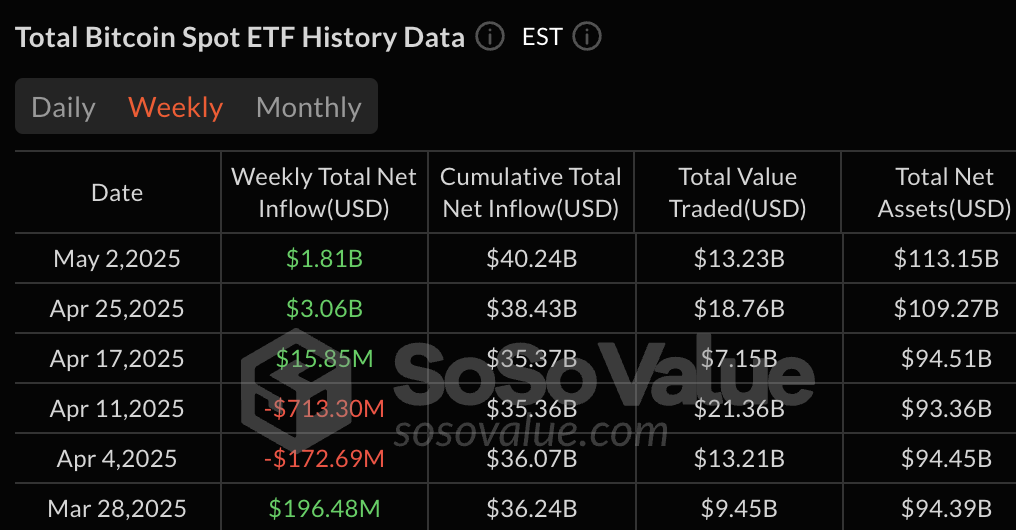

Bitcoin has fluctuated slightly below its three-to-six-month cost basis, around $95,000. Though not too far away from the entry-level for mid-term buyers, it is not very profitable for several of them. We have failed to show a strong upward movement in the recent market action.

While Bitcoin did recover 12.7% from the April lows, it has failed to sustain breakthrough momentum.

Near $97,000, the resistance keeps the gains in check, limiting returns for short—and mid-term investors. However, long-term build patterns still suggest an advantage for possible upsides.

Glassnode’s analysis indicates they will still face until Bitcoin breaks the current resistance level. Although there are temporary spikes, the price requires a sustained increase before it turns profitable for this segment. Meanwhile, Bitcoin’s future looks more reserved against XRP’s more advantageous stance.