Nvidia’s earning reports are to be released on Wednesday for which Wall Street is excited while Evercore ISI stays confident about Nvidia’s performance.

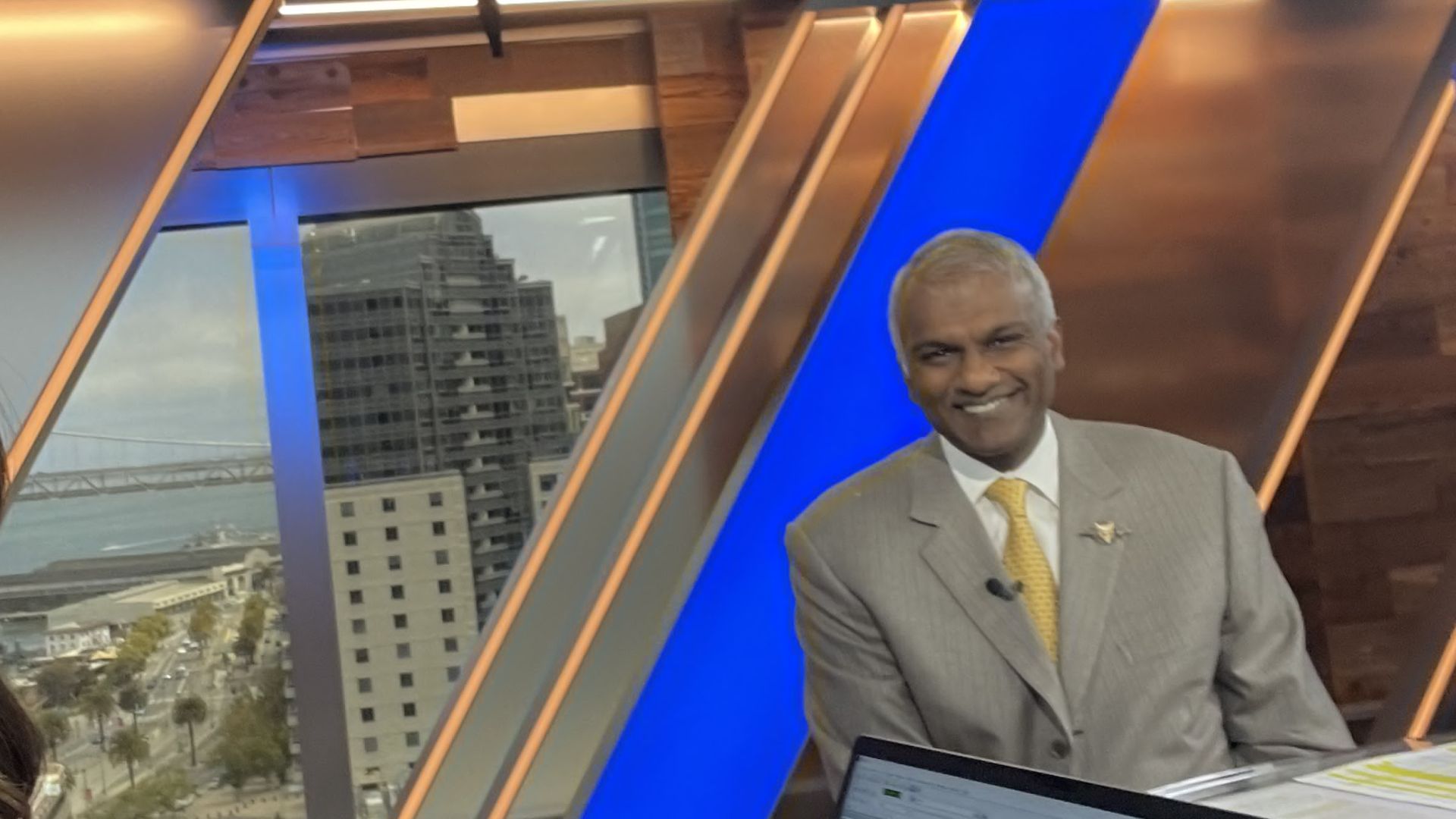

Julian Emanuel, a senior director at Evercore ISI, said on Sunday that it’s well-known Nvidia will exceed earnings per share (EPS) and revenue forecasts of $5.63 per share and $24.6 billion. However, predicting the short-term stock price is hard, even though AI’s long-term benefits are clear.

Nvidia’s stock has closely followed the S&P 500, with a beta of 0.95 over the past year. Emanuel noted that Nvidia’s earnings reports have significantly impacted the S&P 500, citing past earnings reactions that have caused notable market movements.

Market sentiment around Nvidia is influenced by factors like meme stock trades and low volatility, with the VIX around 12. The S&P 500 is highly valued, trading at 23.5 times the last twelve months’ earnings. A recent survey showed AI adoption in American businesses at 4.7%, below the expected 6.4%.

Emanuel is confident about AI’s long-term potential, predicting 25% adoption by 2025, but acknowledges short-term volatility. He suggests that current market fluctuations are part of this volatile journey.

Tech investor Dan Niles thinks Nvidia is still undervalued and has growth potential after its earnings report. Niles noted that Nvidia is about 15% below its 5-year price-to-earnings average, suggesting potential for an increase. He compared Nvidia’s situation to Cisco Systems during the mid-1990s internet boom, which saw significant ups and downs.

It has been advised to investors by Niles to expect periods of consolidation in Nvidia’s stock before it rises again. He mentioned that AI is still growing and will continue to expand, driven by profitable companies.

However, this growth may not be steady. Niles added that everyone expects Nvidia to exceed expectations, reflecting high confidence in the company’s performance.