Key Insights:

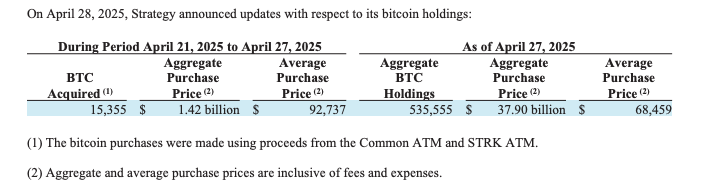

- Strategy acquired 15,355 BTC between April 21 and April 27, 2025, finalizing the purchase on April 28.

- The company spent approximately $1.42 Billion on the latest Bitcoin purchase at an average price of $92,737 per Bitcoin.

- Strategy’s total Bitcoin holdings have now risen to 553,555 BTC, representing about 2.63 percent of Bitcoin’s circulating supply.

Strategy, formerly MicroStrategy, expanded its Bitcoin holdings by acquiring 15,355 BTC between April 21 and April 27, 2025.

Strategy completed the transaction on April 28 to increase its Bitcoin holdings, resulting in a total of 553,555 BTC in its reserve.

This aggressive move reinforced Strategy’s commitment to Bitcoin accumulation as prices increased to $95,000.

The company stated it used $1.42 Billion to acquire additional Bitcoin, buying each for an average price of $92,737.

The company made significant progress in its Bitcoin portfolio value to reach approximately $52.76 Billion based on Saylortracker data.

Despite Bitcoin’s volatility, the Strategy maintained its confident purchase pattern, leveraging bullish market momentum.

During the announcement, Bitcoin reached $93,800 in trading value, which brought it closer to a significant psychological benchmark.

Strategy’s Chairman, Michael Saylor, disclosed the acquisition through a post on X, reflecting strong corporate optimism.

The company’s valuation now approaches $100 billion, as its stock price increased 23 percent throughout the year.

Strategy Buys 15,355 Bitcoin, Strengthening Holdings

Strategy revealed that it bought 15,355 BTC for approximately $1.42 Billion during the past week.

Strategic Chairman Michael Saylor stated that the company spent $92,737 on average for each Bitcoin it purchased.

This acquisition confirmed Strategy’s continued acceleration in Bitcoin accumulation during the first half of 2025.

The company acquired additional Bitcoin, totaling 553,555 BTC, which amounted to 2.63% of Bitcoin’s circulating supply.

Bitcoin price remained strong above $93,000 as the company made its latest Bitcoin acquisition. The strategy’s focus remained clear, as the purchase aimed to strengthen its digital asset strategy.

From Saylor’s perspective, Bitcoin has increased in value by 13.7% since the beginning of the year, thus establishing it as a valuable reserve asset.

The company entered the Bitcoin market by acquiring assets worth $37.90 Billion, which subsequently gained considerable unrealized profits.

Strategy maintained its focus on acquiring Bitcoin despite higher prices than previous purchases.

Strategy Sees Success with Bitcoin Purchases

Before the latest purchase, Strategy bought 6,556 BTC on April 21, spending $555.8 Million at an average price of $84,785 per Bitcoin.

This was preceded by an April 14 acquisition, where Strategy secured 3,459 BTC for $285.8 Million at $82,618 each.

Because of these acquisitions, the data showed consistent exponential growth across consecutive weeks.

The firm executed two significant acquisitions in March 2025, bolstering its Bitcoin holdings as the market rose.

On March 31, Strategy purchased 22,048 BTC for $1.92 Billion, paying an average of $86,969 per Bitcoin.

The company made another Bitcoin purchase of 6,911 BTC on March 24, spending $584.1 Million at an average price of $84,529 per Bitcoin.

On March 17, 130 BTC were acquired for $10.7 Million, demonstrating that the organization continued acquiring Bitcoin throughout the period.

The current Bitcoin market prices indicate that all Bitcoin acquisitions from March through April have become profitable.

The most profitable acquisition occurred on March 31, when the company realized an unrealized gain of $179 Million.

Bitcoin Rally Boosts Corporate Holdings and Profits

As Bitcoin’s price climbed to $93,800 and edged to $95,000, Strategy’s aggressive buying strategy began paying off handsomely.

The average cost basis for Strategy’s Bitcoin was $68,459, significantly below the current market price. Thus, the firm’s long-term accumulation strategy amidst volatility rewarded its conviction.

The company’s market capitalization has surged, driven by both Bitcoin appreciation and rising share prices of Strategy (MSTR).

Shares of this company reached $368.7 after reporting the data, which demonstrated strong cumulative equity market performance.

Strategy moved closer to a $100 Billion market valuation, reinforcing its position as a leading corporate Bitcoin holder.