Key Insights:

- A large XRP Whale transferred 29.53 million XRP worth $68.72 Million to Coinbase during a major price surge.

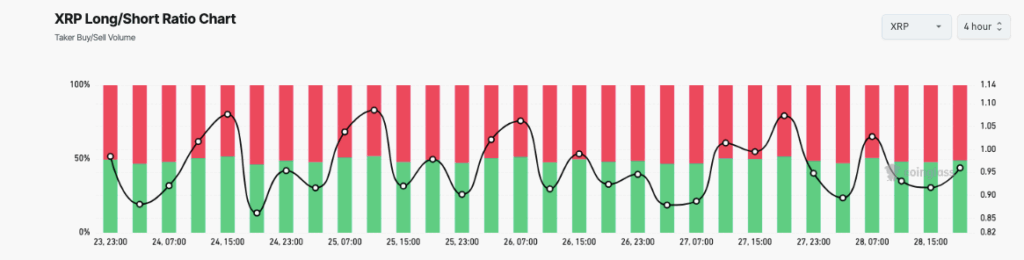

- Derivatives market data shows traders favor long positions with a Long Short Ratio trending above 0.95.

- Analyst Ali Martinez predicts that XRP could reach between $2.70 and $2.90 based on an inverse head-and-shoulders breakout.

A large XRP Whale recently transferred about 29.53 million XRP, worth around $68.72 million, to Coinbase.

The massive transfer occurred as XRP achieved its biggest price point in over a month.

The movement of XRP assets worth $68.72 Million by a high-profile XRP Whale causes market observers to wonder whether this could be a sign of future market turmoil inside Ripple’s systems.

The massive XRP transfer occurred when the currency experienced rapid price growth, reaching its highest point in a month-long period, attracting public market interest.

Large cryptocurrency owners usually take advantage of price spike opportunities to sell their holdings.

This recent whale transaction has fueled extensive speculation because it increases predictions about an upcoming XRP market shift.

Also, the whale transfer occurred strategically when crypto market prices appeared to be steeply rising.

Market analysis indicates that a price decline could be imminent, yet certain experts believe underlying strategies may exist.

The substantial transaction amount has started several discussions about Ripple’s upcoming directions.

XRP Whale Transfer Sparks Sell-Off Concerns

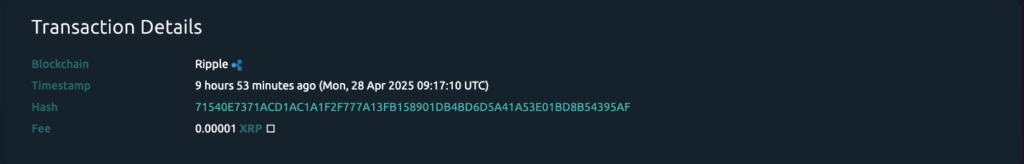

Blockchain monitoring platform Whale Alert recorded the movement of funds from the wallet rnVcQ…dT2Vq to the Coinbase exchange.

The market’s anxiety increases because exchange transfers usually indicate sale intentions. The $68.72 Million transaction acted as fuel that strengthened market concerns about selling activities.

XRP’s recent price growth is an excellent condition for whales to perform profit-taking operations that frequently trigger market volatility during short periods.

When XRP reached its peak level, the whale used the occasion to extract maximum gain before anticipated market fluctuations occurred.

The market shows caution regarding unexpected price drops that mirror such large transactions.

Heavy exchange deposits act as indicators for the future increase in selling pressure.

Periodic crashes following large transactions occur, though single transactions do not necessarily cause market downturns.

Nonetheless, history supports that large transactions signal market issues. The short-term stability of XRP may rely on additional major whale transactions.

XRP Price Holds Strong Despite Whale Transactions

The XRP technical analysis presented by TradingView shows positive signals for the market despite recent whale transactions.

Since its lengthy phase of stagnant trading, the XRP/USD pair maintained a holding value of $2.27.

A continued bullish outlook seems probable because external market forces continue to show restraint.

The Alligator indicator confirms that its jaw tooth and Lip lines show upward movement.

The simultaneous movement of these indicator lines indicates the potential start of sustainable trends when additional technical factors support this assessment.

A small group of traders keeps a positive outlook because their trading positions do not align with the skepticism created by whale market actions.

Technically, the Relative Strength Index (RSI) indicates 59.42, which reveals improving market strength without crossing into overbought territory.

Both technical indicators strengthen each other when they cross above zero, which points to future positive price movements.

Technical predictions may be overridden by sudden whale activities, which traders need to keep in mind.

XRP Derivatives Data Signals Growing Optimism

In derivatives markets, XRP’s Long/Short Ratio currently trends above 0.95, indicating more traders are favoring long positions.

These minor changes in ratio value support the widespread positive market outlook for XRP. The derivatives data prove that traders believe XRP will continue to rise in value.

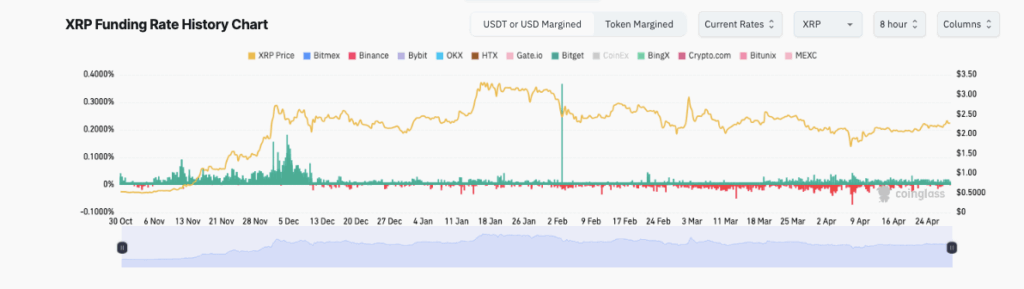

The funding rate at Binance and Bybit refuses to dip below zero, which demonstrates substantial investor interest in buying XRP.

The bull market expands with rising spot prices and positive funding rates, which support continued market ascension.

Consequently, these metrics suggest underlying confidence in XRP despite headline risks caused by whale movements.

Additionally, broader market recovery efforts contribute to XRP’s recent price action, offering a supportive backdrop for further gains.

Derivative signals serve market participants as indicators for short-term price movements since they utilize derivatives during uncertain financial periods.

The strength of derivatives market conditions helps reduce negative perceptions from whale trading activity.

XRP Eyes Fresh Highs Amid Bullish Pattern

Crypto analyst Ali Martinez recently noted that XRP might be breaking out of an inverse head and shoulders pattern.

A technical analysis by the expert professional shows the price predictions extending from $2.70 to $2.90.

Therefore, if this pattern plays out entirely, XRP could soon hit fresh highs despite whale-related fears.

When patterns break, swift price movements, booming market sentiment, and heavy trading activity tend to occur.

Given current momentum indicators and derivatives positioning, XRP could maintain its uptrend toward the stated targets.

The ongoing whale transactions act as an unstable factor that threatens to alter or confirm this market projection.

Furthermore, broader macroeconomic developments and regulatory headlines may influence XRP’s trajectory in the coming days.