Key Insights:

- The overall cryptocurrency market is gaining strength, with a total market capitalization rising to $2.66 Trillion.

- ADA tests a key support-turned-resistance level near $0.60, which could signal a shift if broken upward.

- Dogecoin is showing renewed strength and is trading at $0.1559 after bouncing back from a low of $0.151.

The cryptocurrency market is showing renewed strength, with Cardano (ADA) and Dogecoin (DOGE) beginning to recover recent losses.

Both digital assets are gaining momentum as market sentiment turns positive and key indicators shift direction.

While ADA and DOGE faced downward pressure last week, new signals suggest a potential for upward movement.

Cardano Eyes Breakout as Momentum Builds

Cardano rebounded from a recent low of $0.5165 and was trading at $0.6186, reflecting a 0.07% drop.

Intensified growth in the market manifested through a total crypto market cap reaching $2.66 Trillion with a 0.91% upward movement.

The altcoin stands near an essential support zone, which used to act as resistance at $0.60.

Analysts note that Cardano is now positioned on a short-term support trendline, creating a potential setup for a trend reversal.

For this shift to gain strength, ADA must close a 4-hour candle above $0.67, confirming market interest.

After an eventual breakout, the next critical price target for ADA will most likely be $0.70, as per near-term forecasts.

Technical expert AMCrypto highlights that ADA’s recovery coincides with a broader bullish pattern across the crypto market.

However, the major upward price moves may face obstacles because of external geopolitical conflicts, mainly between US-China relations.

Until global trade stability returns, ADA may continue testing support and resistance within a narrow trading range.

ADA May Retest Key Support Zones

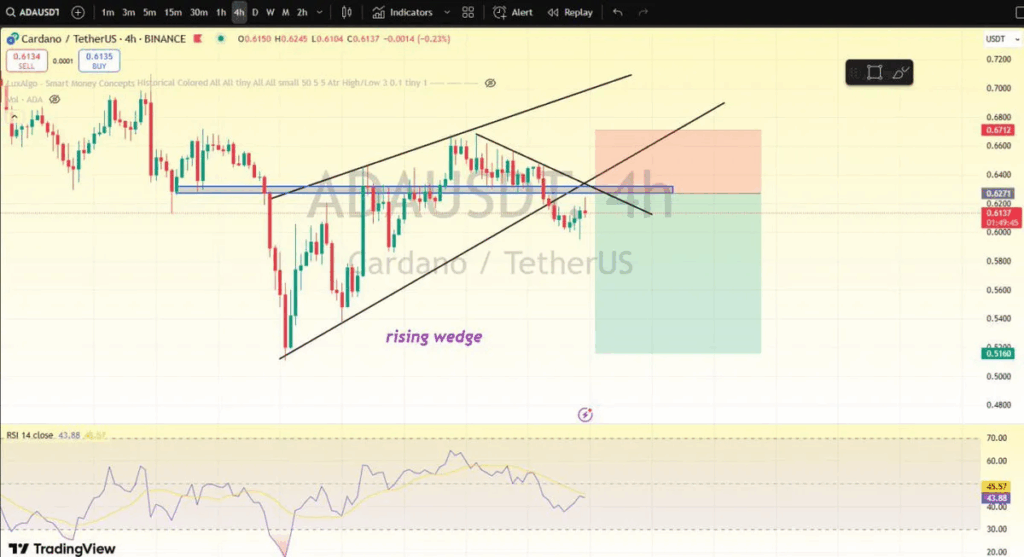

Another market observer, Bit Bull, identified a rising wedge pattern on the 4-hour ADA/USDT chart.

The technical pattern, which has been developing since early April, displays characteristics of downside pressure, which is recognized for its bearing on price movements.

The pattern’s upper boundary may act as resistance, potentially pushing ADA lower in the short term.

According to Bit Bull, an upper wedge edge retest will occur before ADA moves towards its support areas.

According to him, the strategic support levels start at $0.60, move towards $0.55, and finish at $0.52.

Unless ADA breaks the pattern with strong volume and momentum, this outlook may delay a broader rally.

Despite this short-term pattern, ADA holds strong long-term potential if market conditions remain favorable and buying pressure increases.

Professional analysts predict that ADA price movements above the descending trendline will likely result in $1.51 as a prospective target.

Traders who seek entry positions before price breaks the patterns will watch the major support zones near technical levels.

Dogecoin Pushes Higher Amid Positive Sentiment

Dogecoin was trading at $0.1560, up 0.6% at press time. It showed strength after recovering from a sharp drop to $0.151.

This rebound highlights DOGE’s resilience, as buying pressure supports price action amid improving sentiment across the crypto market.

The meme coin reaches attention because its active community works with bullish price predictions.

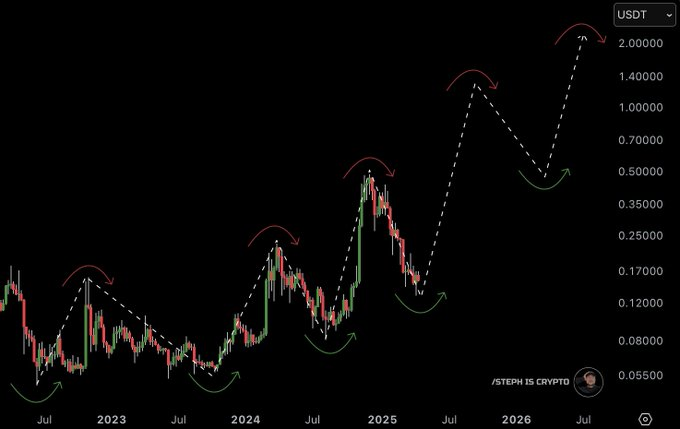

Crypto analyst STEPH IS CRYPTO predicts DOGE could reach $2 within three months, citing strong demand and a positive market structure.

CryptoSurf embraces this prediction that the coin will reach above $1 within the next term due to its continuous market momentum.

These projections reflect growing enthusiasm as Dogecoin outpaces many altcoins in recovery strength.

Dogecoin’s current price structure shows bullish continuation, though sustained growth depends on volume and broader market behavior.

If DOGE maintains support above $0.150, it could build toward the $0.20 level in the coming weeks.

After facing resistance at these critical zones, the price may undergo temporary periods of stagnation or small pullbacks.