Key Insights:

- Bitcoin miner selling pressure drops to the lowest levels since Mid-2024.

- Bitcoin’s hashrate shows signs of weakness after reaching an all-time high.

- New Bitcoin whales are rapidly accumulating as the price continues to climb.

Bitcoin miners are seeing the lowest selling pressure since May 2024, while new Bitcoin whales are piling up. BTC’s hashrate also looks weak, but the current market cycle looks like the last one before the 2017 bull run.

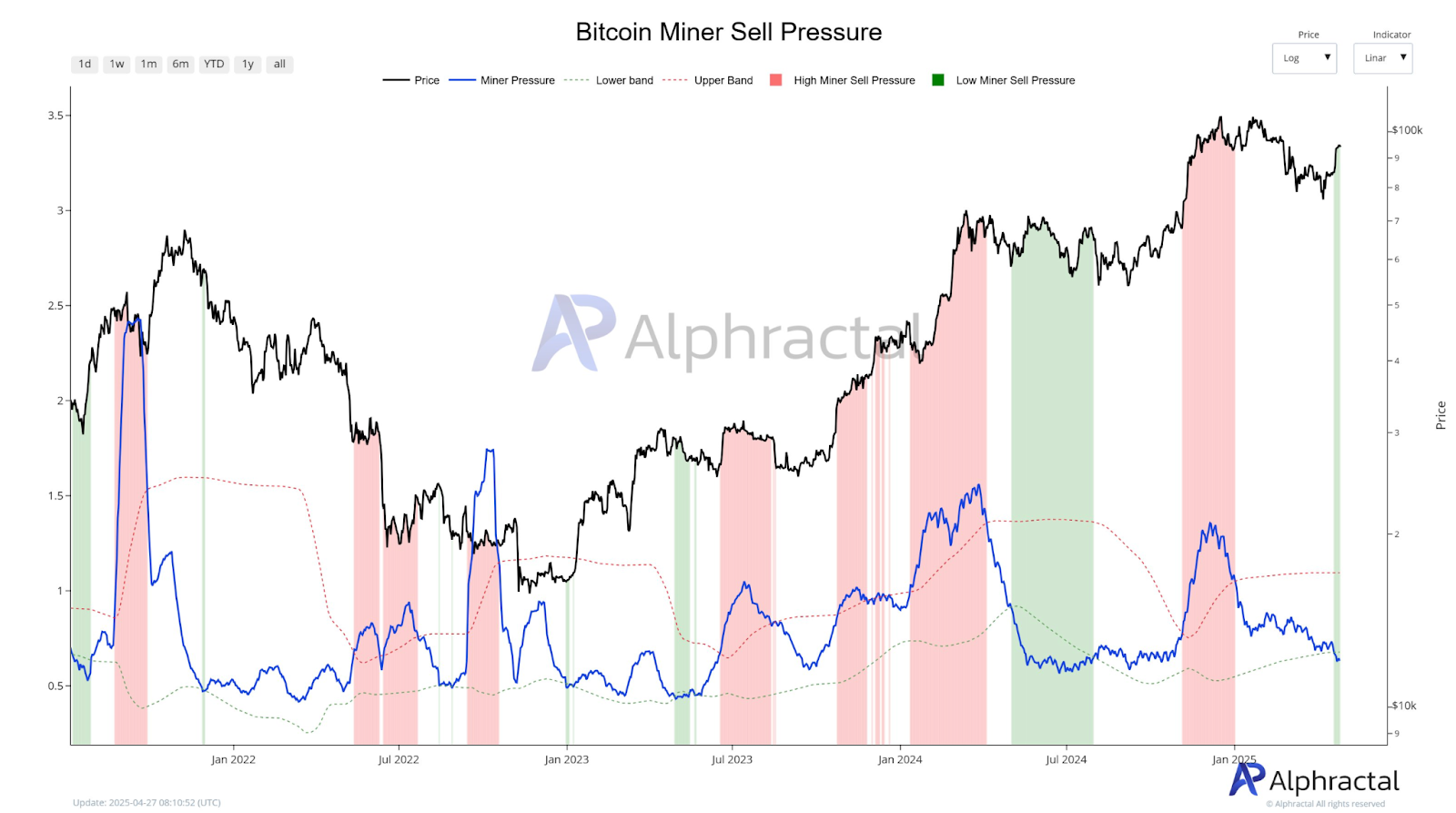

Bitcoin Miner Selling Pressure Drops to Historic Lows

Data from Alpharactal shows that Bitcoin miners are recording the lowest selling pressure since mid-2024. The blue line, miner pressure, is heading towards the lower green band, meaning that Bitcoin sales by miners are decreasing.

In the past, low mining selling pressure mainly resulted in Bitcoin trading sideways or down. Rarely have there been positive reactions after low-selling periods.

Most happened in January 2022, August 2022, May 2023, and July 2024. In most other cases, Bitcoin entered consolidation phases or downtrends.

Bitcoin price was relatively strong in January 2025, when the selling pressure was low. This implies that miners sold much of their Bitcoin early in 2025 when prices were more favorable.

The reduced selling activity could now ease the immediate supply pressures. However, upward movement cannot be guaranteed without new buying strength.

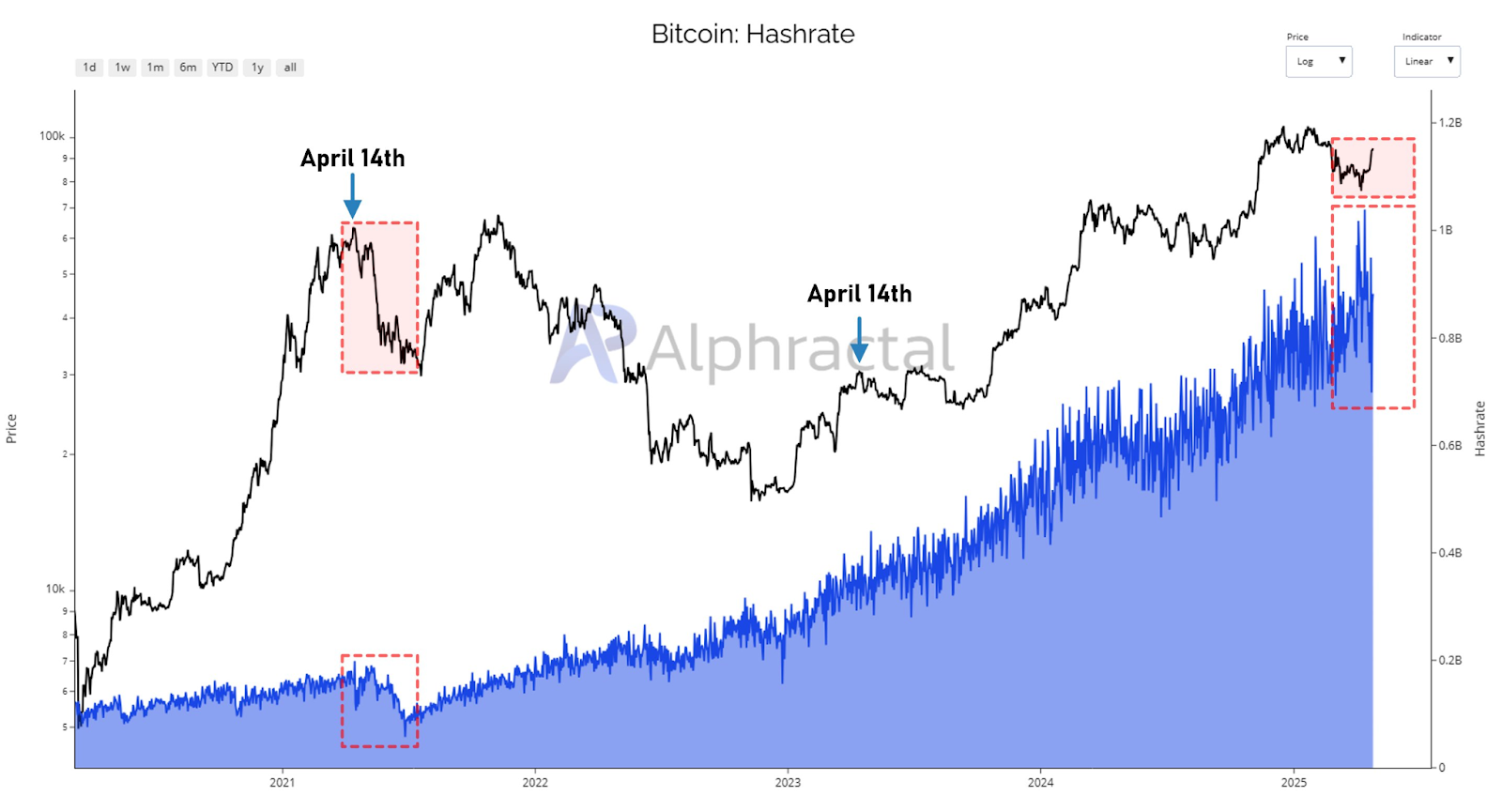

Hashrate Trends Raise Concerns About Mining Stability

Bitcoin’s hashrate surged to 1.2 billion terahashes per second (TH/s) in April 2025. According to Alphractal’s tracking, this milestone marks unprecedented network strength and security. After this peak, the hashrate dropped sharply but recently recovered slightly.

Historically, April has been an essential month for Bitcoin mining and price behavior. Bitcoin local tops were recorded on April 14, 2021, and April 14, 2023. April 2025 was not a new price peak. However, the hashrate drop after it is similar to past weakening phases following network peaks.

A hashrate that is declining can mean that mining profitability is declining. As operational costs increase and rewards decrease, weaker miners will start selling Bitcoin to cover losses. The selling of this could increase supply and put pressure on the Bitcoin market.

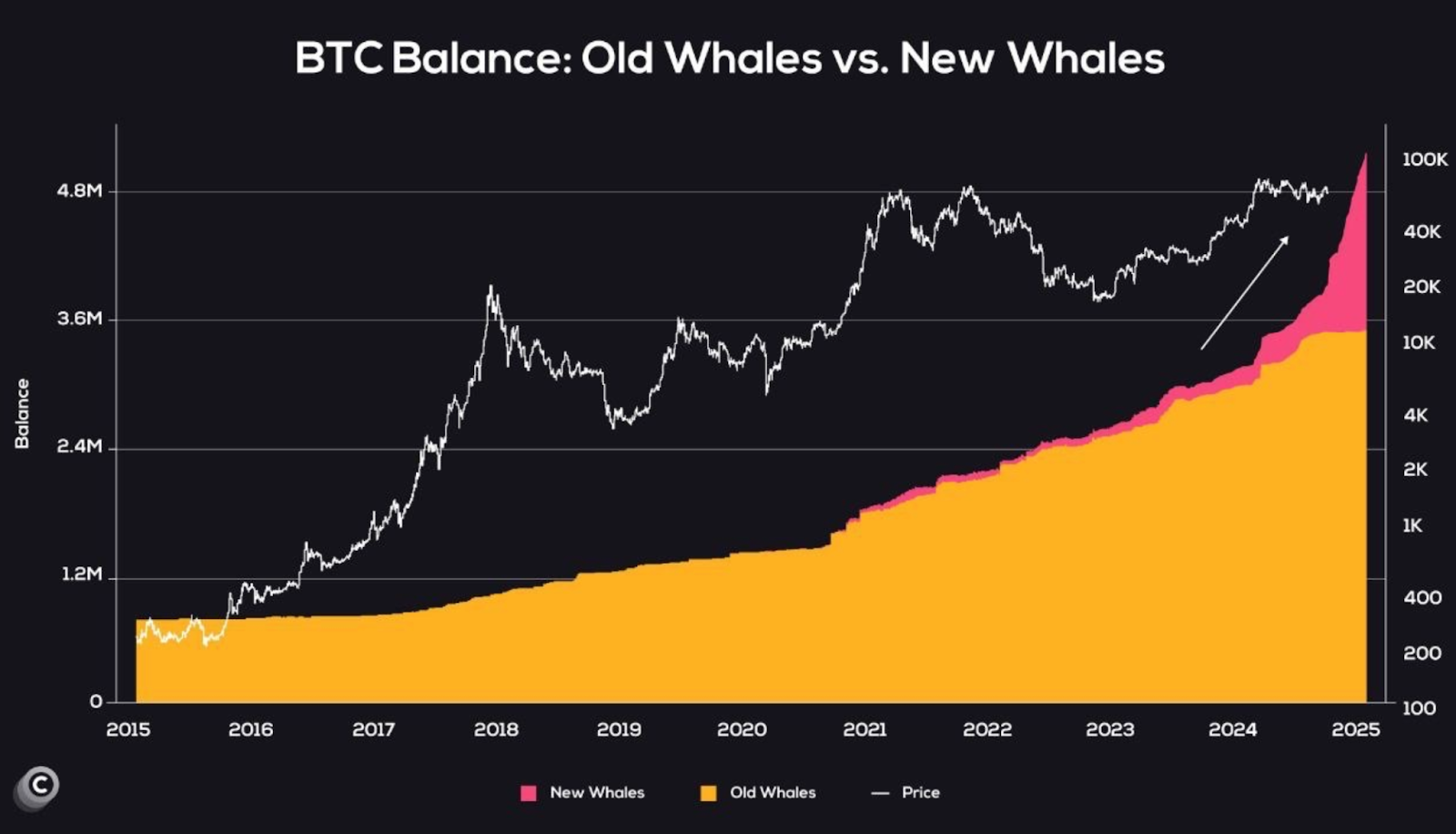

New Bitcoin Whales Rapidly Accumulating

However, new data from Coinvo reveals that a new group of Bitcoin whales is growing fast. As Bitcoin’s price goes up, the balance held by new whales has been increasing sharply.

The Bitcoin balances chart shows that new whales (pink) are accumulating Bitcoin at the fastest rate in years. Old whales, shown in orange, have not been selling heavily but are holding firm.

The increase in new whale balances indicates new money is entering the market. At a time when miner selling pressure is low, this inflow of new buyers could add to demand and liquidity.

Continued whale accumulation could stabilize the Bitcoin price structure in future phases. This trend may support sustained price growth if mining conditions remain tight and miners’ selling stays low.

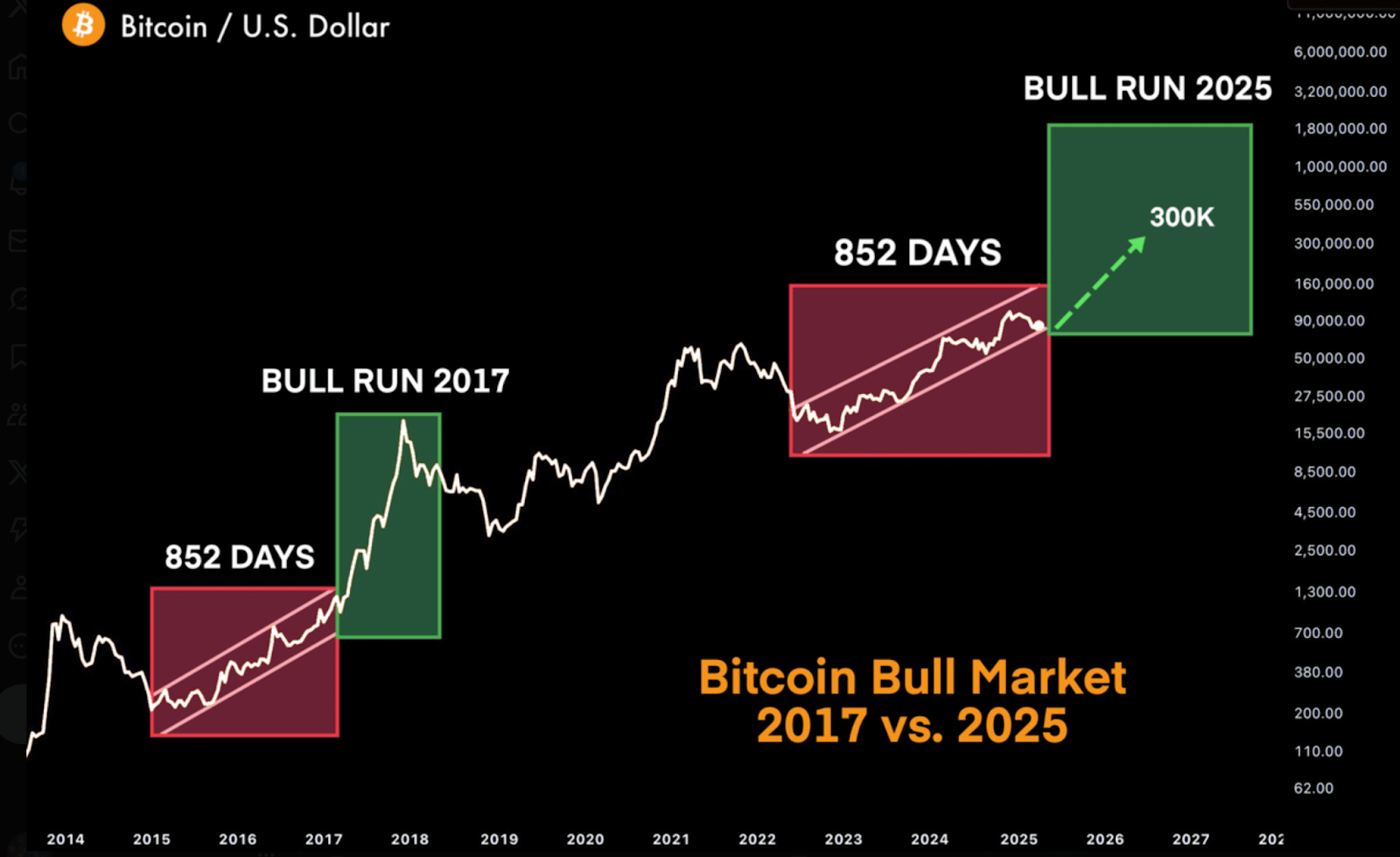

Comparing Bitcoin’s 2017 and 2025 Bull Market Patterns

At the same time, technical analysts reveal that Bitcoin’s current market structure is a close match to the 2015–2017 cycle. In both cycles, Bitcoin took about 852 days to spend inside an upward trend channel before a major breakout.

Bitcoin climbed slowly from 2015 to 2017 for 852 days before entering a strong bull run that ended at the end of 2017. The 2023–2025 cycle is ongoing, and the setup is almost identical, leading to the expectation of a potential breakout later in 2025.

Bitcoin could target $300,000 if the historical structure repeats, as the model shared by analyst Danny. His model also predicts that Bitcoin will follow the same long build-up before a breakout as in 2017.

However, in some ways, conditions today differ from those in 2017, with more regulatory pressures and macroeconomic shifts. These external factors could affect the speed and scale of Bitcoin’s next move.