Key Insights:

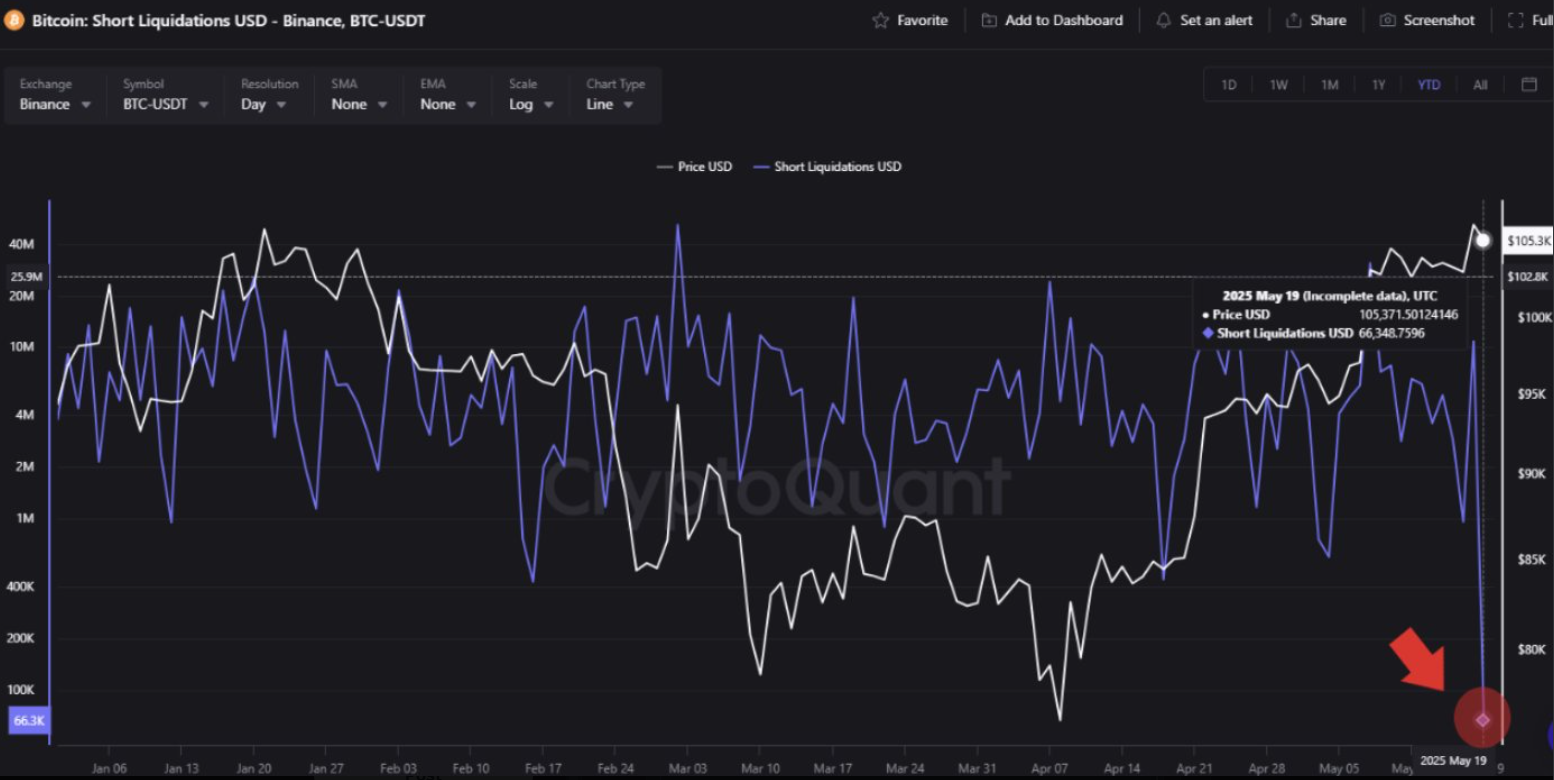

- Binance recorded the year’s largest short liquidation, totaling $66.3 million on the BTC/USDT trading pair.

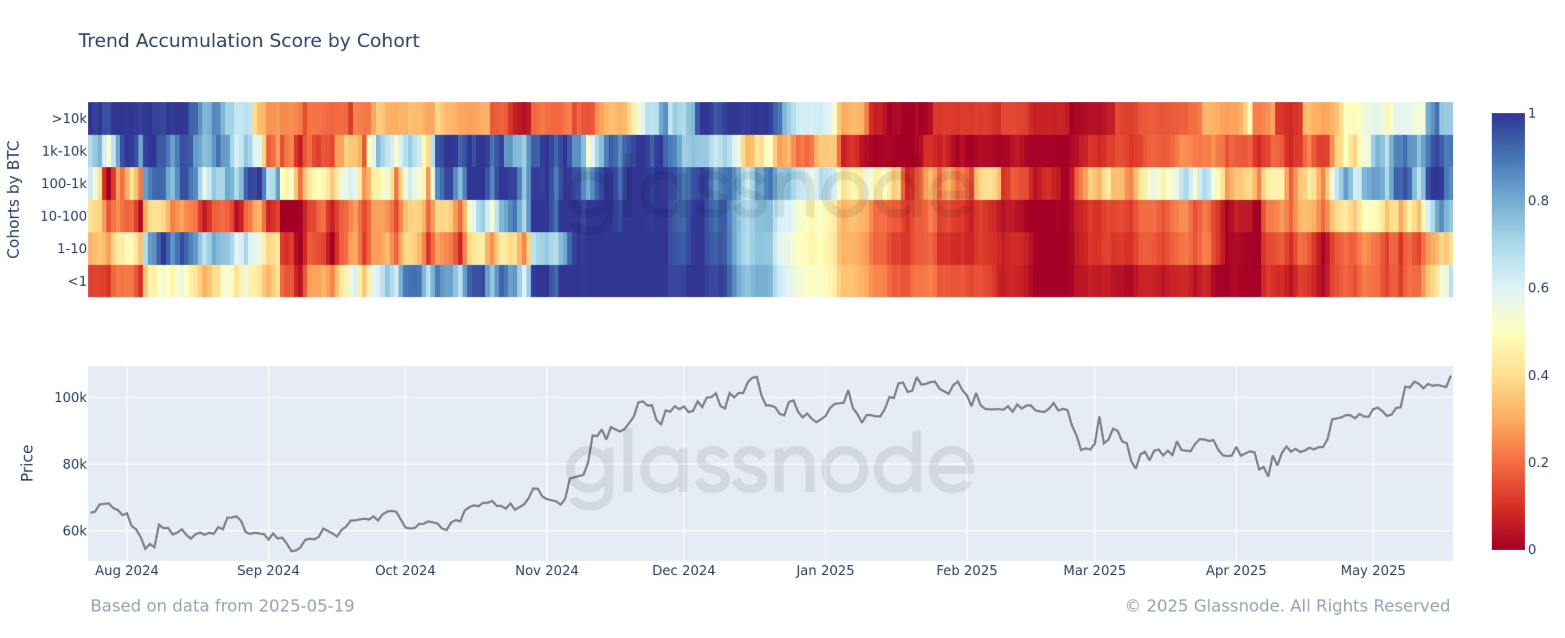

- Wallet data shows increasing accumulation across nearly all holder groups, led by large BTC investors.

- A supply cluster at $106.6K, holding 31,000 BTC since December, continues to act as price resistance.

Bitcoin shows strong upward momentum following a major short liquidation event on Binance. There, $66.3 million in positions were wiped out. This marks the largest such event of 2025, triggering renewed interest in price movement and investor behavior.

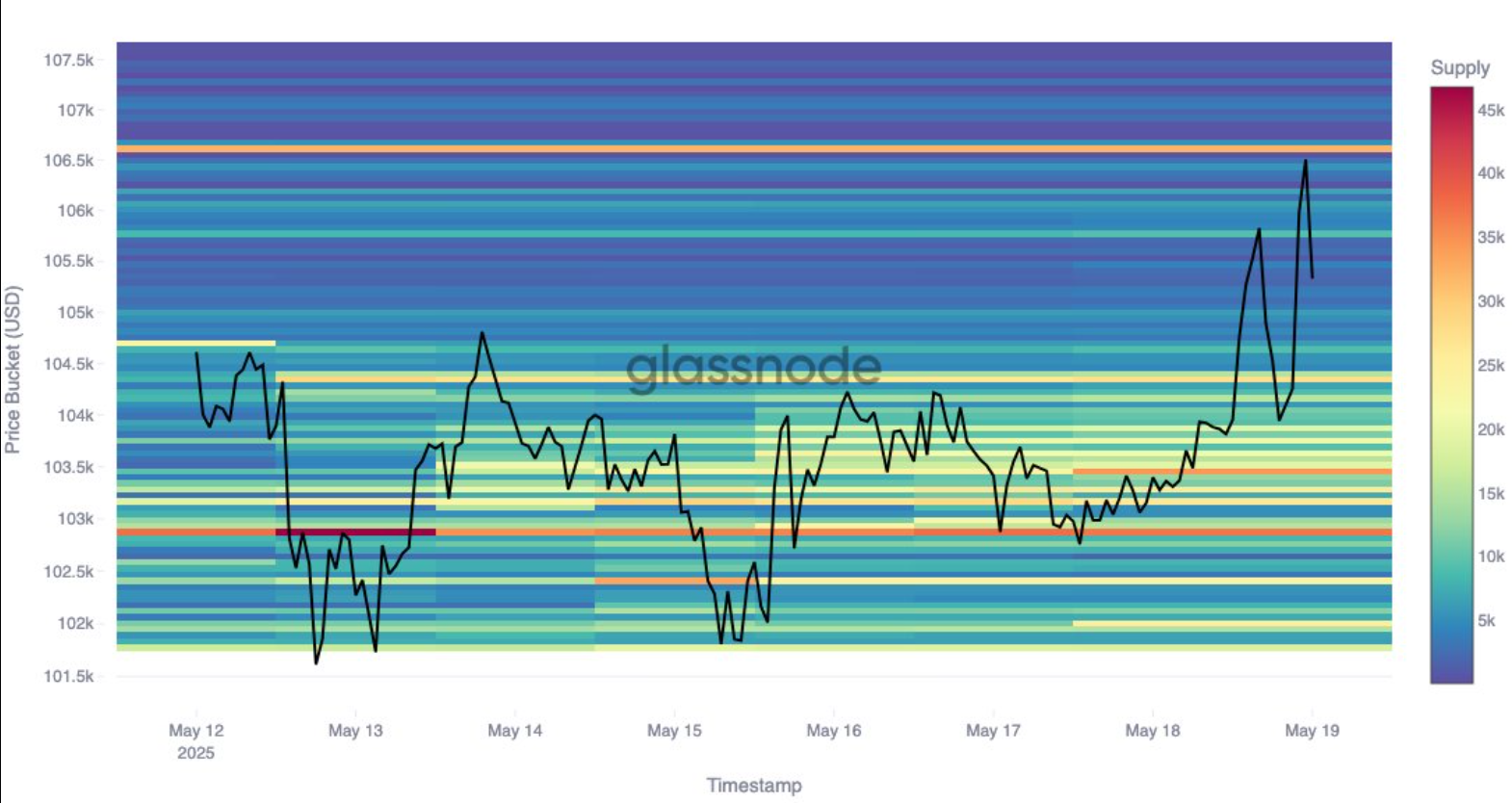

Meanwhile, the accumulation rate is rising for nearly all types of wallets. Despite vigorous buying activity, Bitcoin struggles to break past the $106.6K resistance level. 31,000 BTC have remained untouched since late 2024, adding to the market uncertainty.

$66.3M in Shorts Liquidated on Binance: A Shift in Market Sentiment

On May 19, 2025, Binance experienced its biggest short liquidation on the BTC/USDT pair for the year. In a few hours, $66.3 million in short positions were eliminated.

Short liquidations occur when traders borrow Bitcoin, expecting the price to drop. If the price increases, they have to pay more to repurchase it, which leads to a squeeze. The sharp price rise caused the squeeze, taking Bitcoin above $106,000 before it pulled back a little.

Bitcoin’s price is struggling to rise beyond $106.6K due to heavy buying at that level. Glassnode reports that over 31,000 BTC have been purchased there, creating strong resistance. Since December 16, 2024, this cluster has not changed.

The fact that the coins are not being moved by those at that level indicates they are not interested in selling. Bitcoin reached this level but then dropped, indicating that it might take more energy to break through.

Wallet Cohorts Show Accumulation Across the Board

Moreover, Bitcoin is being held by people with wallets of all sizes. Holders with less than 1 BTC accumulate instead of selling, as the trend accumulation metric is 0.55.

Those who hold 100 to 1,000 BTC tend to have a strong score of nearly 0.9. The group with 1,000 to 10,000 BTC has a score of 0.85, just slightly lower than the top group. It shows that even major investors are still increasing their investments.

Only those with 1 to 10 BTC wallets still sell their coins. Their score is less than 0.5, meaning they sell more than they buy. If Bitcoin remains above $100,000, they may soon start accumulating more.

The heatmap in the data clearly shows this. Red and orange, indicating high accumulation, are seen in almost all age groups. Blue tones show selling and are now only present in a few locations.

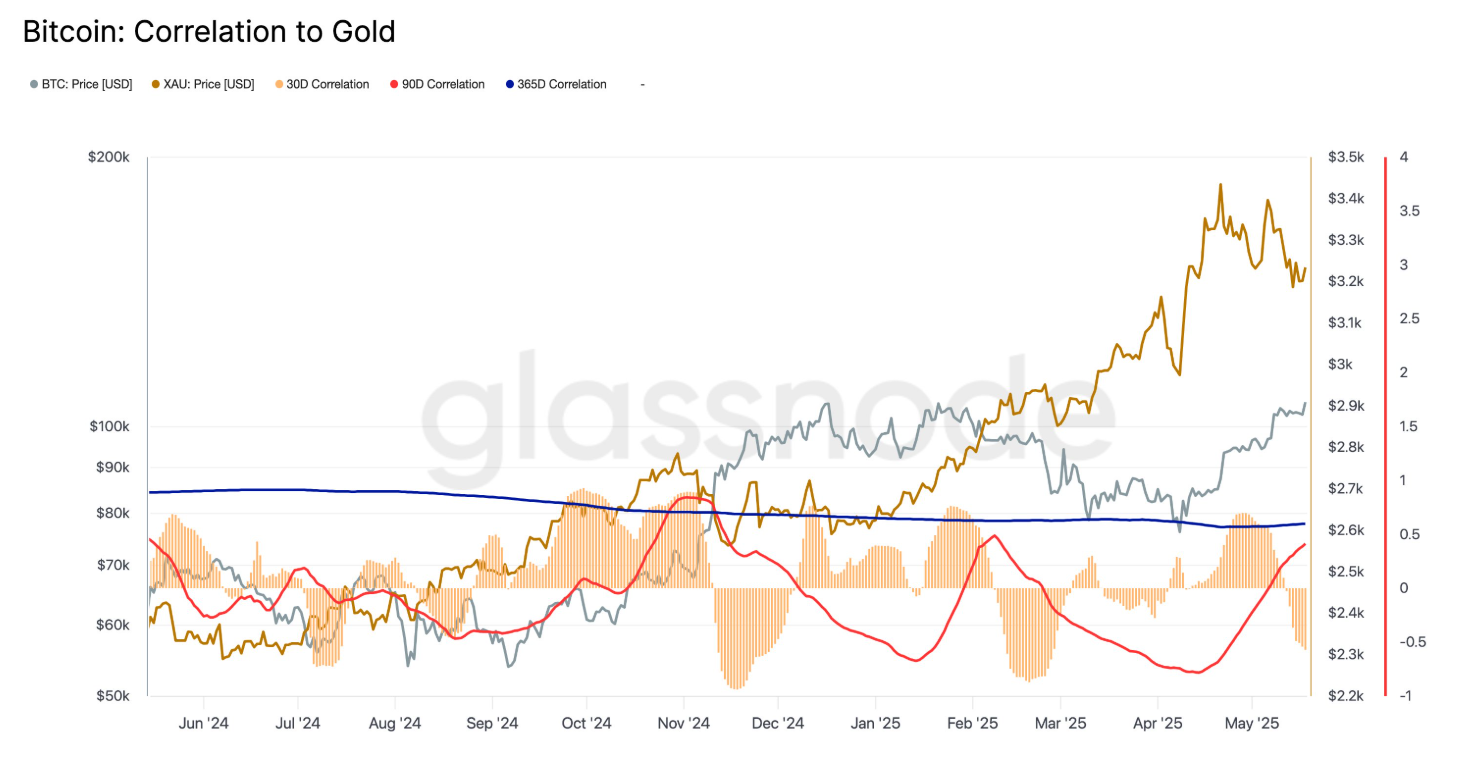

Bitcoin-Gold Correlation Turns Negative in the Short Term

On the other hand, Bitcoin’s connection to gold over the past 30 days is now -0.54. It is the lowest level seen since February 2025. This means that Bitcoin is moving up while gold is moving down. Bitcoin tends to go down when gold goes up, and the opposite is also true.

At the same time, the relationship between the two remains positive over the longer term. The correlation for 90 days is 0.39, while it is 0.60 for 365 days. These statistics indicate that Bitcoin and gold have moved together for several months.

It seems that Bitcoin is now responding more to changes within the crypto market than to the overall economy. While gold has dropped in price, Bitcoin faces new resistance levels.

Gold reached a high of $3,400 in early May, but its price has since dropped to below $3,300. Meanwhile, Bitcoin has reached $105,000 in the same period, suggesting it is not performing the same as gold.

What the Data Means for Bitcoin’s Next Move

Because of the quick liquidations, traders betting against Bitcoin had to close their positions. As a result, the price rally drew near $107,000.

The increase in wallet activity is also driving prices higher. Most investors are still buying, which will help the market in the long run. For now, only the 1 to 10 BTC group is still distributing. However, things could change if prices stay the same or increase further.

The level of resistance at $106.6K should be monitored. A move above that level could allow the price to reach new heights. Still, a high supply might slow down any further gains at that stage.

In the short run, Bitcoin has become independent of gold. This could mean it can soon choose a different direction than traditional safe-haven assets.