The aftermath of the regional banking crisis that shook the industry in March 2023 continues to cast a shadow over smaller U.S. banks, with hundreds now grappling with wounds inflicted by the same forces that consumed their larger counterparts.

Despite a semblance of recovery, the industry remains ensnared by challenges from high-interest rates and lingering unrealized losses.

According to a veteran investment banker, discussions among bank CEOs regarding mergers have reached unprecedented levels, reflecting a growing acknowledgment of the need for strategic partnerships in clearing the current financial areas.

Impact of Persistent High-Interest Rates

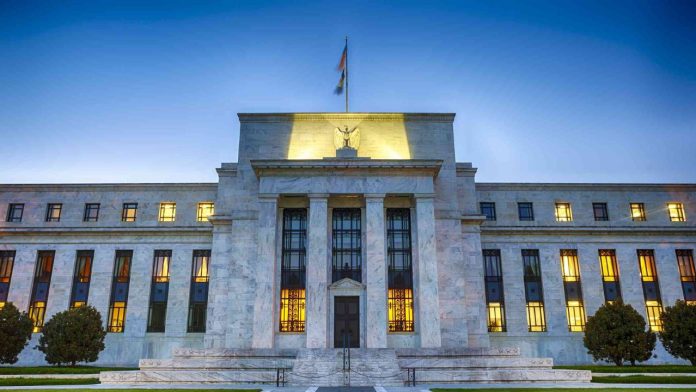

The Federal Reserve’s prolonged period of interest rate hikes, culminating in 11 increases through July, has yet to yield a reversal, leaving banks burdened with substantial unrealized losses on low-interest bonds and loans.

This scenario, compounded by potential setbacks in commercial real estate, poses a significant threat to the stability of numerous banks across the country.

Vulnerable Banks and Potential Remedies

Analysis conducted by consulting firm Klaros Group reveals that 282 U.S. banks face heightened risks due to their exposure to commercial real estate and substantial unrealized losses from the interest rate surge.

This precarious situation may necessitate urgent measures such as raising fresh capital from private equity sources or engaging in merger activities to fortify their financial positions.

Amidst the option of waiting for bonds to mature and roll off their balance sheets, banks risk prolonged periods of underperformance, akin to operating as “zombie banks.”

This strategy not only undermines economic growth within their communities but also exposes them to escalating loan losses, further exacerbating their vulnerability in the market.

Despite a sluggish environment for mergers and acquisitions, bank leaders are increasingly recognizing the imperative to explore consolidation opportunities.