Key Insights:

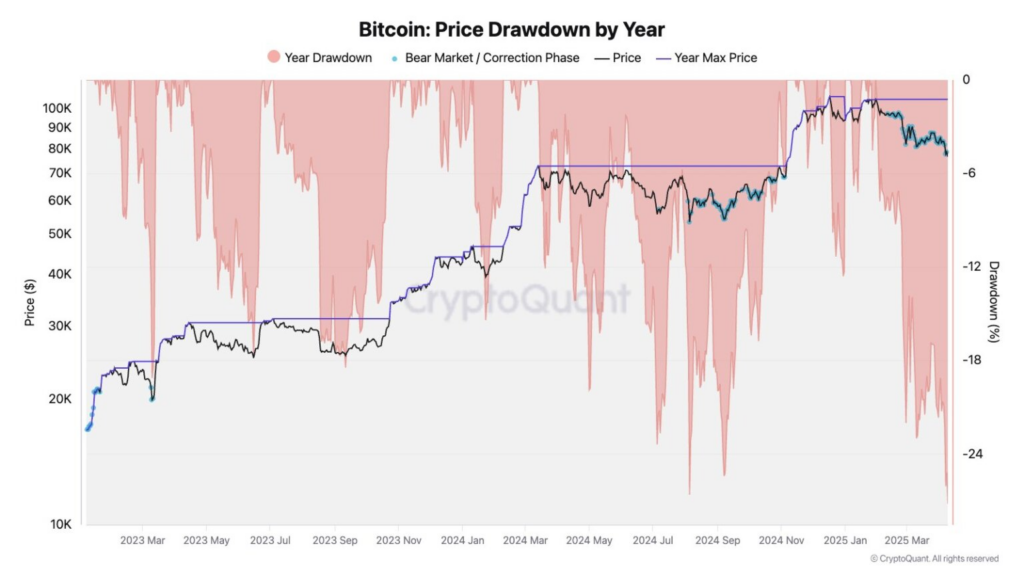

- Peter Schiff has stated that Bitcoin is now in a major bear market based on its underperformance against gold.

- Since November 2021, Bitcoin has lost 30 percent of its value when measured in gold despite positive market developments.

- Schiff argues that Bitcoin does not behave like a store of value but trades like a high-risk speculative asset.

Peter Schiff, a persistent Bitcoin skeptic, has criticized BTC again. He asserted that cryptocurrency is currently experiencing a significant bear market.

Schiff based his remarks on Bitcoin’s sharp underperformance against gold since its all-time high in November 2021. He pointed out that Bitcoin has lost 30% of its value when measured in gold, despite several bullish developments.

While institutional interest and regulatory support have increased, BTC price has failed to show corresponding gains against gold.

Schiff argues that this undermines the “digital gold” narrative promoted by crypto advocates and institutions. His statements come amid visible losses in high-profile Bitcoin acquisitions, including recent purchases by Strategy.

Performance of Bitcoin Against Gold Raises Fresh Doubts

According to Peter Schiff, BTC has experienced continuous price depreciation against gold in the last few years. Since November 2021, Bitcoin has faced notable market losses. This happened despite ETF approvals, and institutions have started to adopt cryptocurrency.

As per Schiff, this financial pattern creates an opposing relationship between the typical Bitcoin and physical gold comparisons.

Some of Bitcoin’s public support includes claiming that cryptocurrency is an up-to-date way to preserve wealth. According to Schiff, current market data speaks against this assertion.

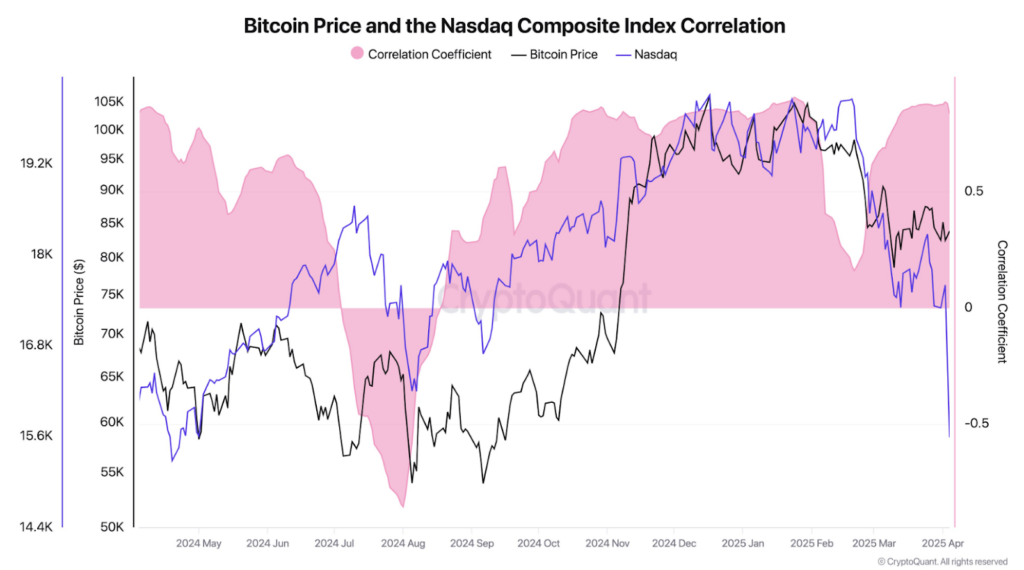

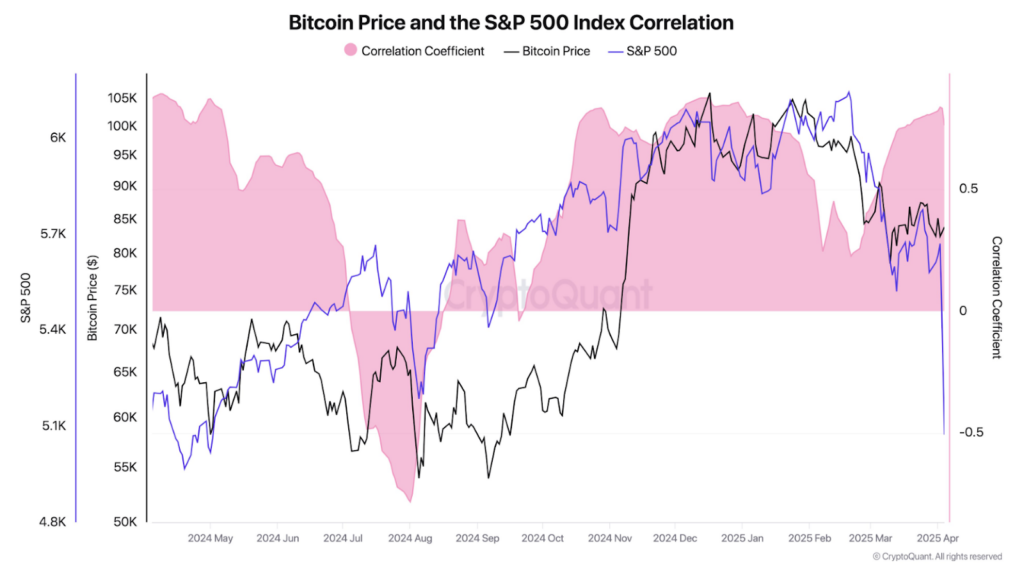

Bitcoin demonstrates its characteristics as a speculative technology investment rather than a dependable hedge instrument. According to Schiff, Bitcoin price patterns resemble those of speculative, high-risk equity markets.

The expert noted that gold maintains stability during market fluctuations, while Bitcoin suffers considerable price drops. Due to this price movement, Schiff believes the asset classification as low risk faces challenges.

Strategy Faces Losses Amid Aggressive Bitcoin Bets

Strategy, under CEO Michael Saylor, advocates for BTC and has experienced challenges because Bitcoin’s value has decreased.

The company purchased its Bitcoin in March 2025, securing 22,048 BTC units at $86,969 each. Since then, the company’s $1.92B Bitcoin investment has decreased by approximately 5.08%, or $97 million.

During February 2025, Strategy suffered especially significant financial losses beyond what they had experienced. Strategy purchased 20,356 bitcoins on February 24 for $97,514 per coin, and they experienced a decrease of 15.44%.

A drop amounting to $307 million exceeds the current worth of Bitcoin acquired in that transaction alone. BTC purchase made on February 10, totaling 7,633 coins at $97,255, has resulted in a 15.01% loss.

The price drop resulted in a $111 Million investment loss on this transaction. The company has maintained a small profit on its March 17 acquisition of 130 bitcoins at $67,382.

Peter Schiff Questions Bitcoin’s Safe Haven Role

Peter Schiff argues that BTC fails to meet its branding as “digital gold.” He provides evidence suggesting it does not function effectively as a safe store of value.

He argues that Bitcoin’s performance during the economic downturn reveals its shortcomings. If it were a reliable protective asset, he claims, it would have demonstrated greater resilience. When measured against Bitcoin, gold demonstrates contrasting performance.

Schiff condemns investors who maintain a wrong assumption about Bitcoin as a secure investment asset. According to him, BTC functions like a speculative stock rather than a defensive investment. The high level of price volatility impedes its suitability for strategic reserves.

Schiff expressed doubts about why institutions purchase this unstable investment. According to Schiff, the value of strategic reserves should remain consistent while being predictable.

The unpredictable price variations of Bitcoin make him doubt its worth as a strategic reserve, according to his viewpoint.

Schiff Urges Rethink of Bitcoin’s Investment Role

Peter Schiff attacked Bitcoin on two fronts: evaluating its price movements and challenging its classification as an asset. According to his assessment, the lack of income generation and ownership in productive enterprises makes Bitcoin unable to sustain high value.

In his opinion, investors must weigh the justification for maintaining their Bitcoin investments. According to Schiff, Bitcoin attracts purchasers mainly because individuals sense widespread market positivity and readiness to take risks.

Such characteristics make BTC function similarly to momentum-based assets, which diverge from traditional hedging instruments. Schiff presented that Bitcoin does not possess essential qualities that constitute safe-haven assets.

He demanded that institutions show evidence of investment decisions regarding this volatile commodity class. The gold-like properties of Bitcoin fail to match the standards needed to earn its classification as “digital gold.”

Strategy’s Bitcoin Strategy Faces Mounting Pressure

Despite mounting paper losses, Strategy’s continued Bitcoin purchases have triggered growing concerns among investors and analysts. All significant investments acquired by the company since February 2025 have shown negative performance in April 2025.

The substantial amounts of Bitcoin ownership and significant losses led firms to accumulate renewed inquiries. The large purchase of 22,048 BTC at $86,969 on March 31 represents the biggest deal and has depreciated by 5.08%.

February 24’s largest Bitcoin purchase resulted in the firm’s biggest loss. A 15.44% decline affected the 20,356 BTC acquired on that date. These transactions have caused the firm to suffer a paper loss of more than $500 Million.

The price of BTC has decreased during this period. However, positive market developments like ETF approvals and corporate adoption typically support Bitcoin’s market value.

Based on his analysis, Schiff maintains that Bitcoin has lost its institutional support based on the observed decreases in Bitcoin investments. According to Schiff, Bitcoin’s decay has removed its investment potential.

Institutional Optimism Fails to Offset Declining Value

Bitcoin’s recent downturn in a market environment with promising characteristics provoked uncertainty regarding its enduring stability. Bitcoin has struggled to capitalize on positive market conditions.

Despite presidential support for cryptocurrency and innovative financial systems, its performance remains unimpressive. Bitcoin is still under downward market pressure even as Strategy and other businesses expand their leveraged acquisitions.

Peter Schiff uses this mismatch to demonstrate significant shortcomings within the Bitcoin theory. In his opinion, Bitcoin’s decreasing value appeal remains despite its institutional backing.

(@justinsuntron)

(@justinsuntron)