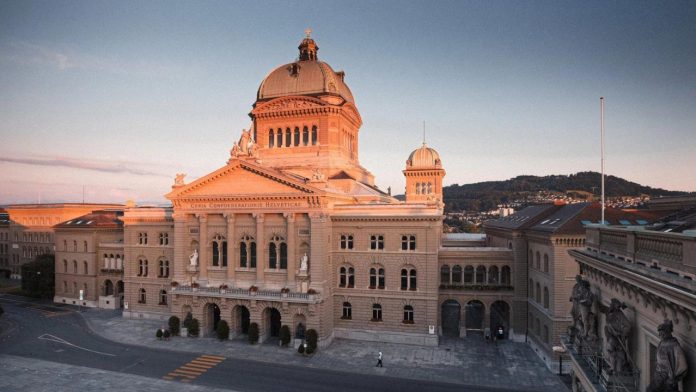

In a significant move, Switzerland’s lower house of parliament passed a motion late on Wednesday aimed at imposing accountability measures on senior management of major banks in the event of a bailout with public funds.

The motion, which awaits further debate in the upper house, proposes that top executives of systemically relevant banks return half of their income earned over the past decade if the bank requires government rescue assistance.

This motion follows Switzerland’s provision of emergency liquidity amounting to billions of dollars to Credit Suisse, a major Swiss bank before it was eventually taken over by its rival UBS.

What Is The Next Aim?

The proposed measure is a response to such instances, aiming to ensure that bank executives are held responsible for the financial health of their institutions.

According to the motion, if a systemically important bank receives government assistance during a crisis, its senior management should reimburse 50% of its regular pay and bonuses earned over the previous 10 years.

The goal is to enhance accountability and discourage risky behaviour among bank executives, particularly in scenarios where taxpayer money is utilized to stabilize financial institutions.

The motion, introduced by a politician from the right-wing Swiss People’s Party (SVP), explicitly references the 2023 Credit Suisse case and the 2008 bailout of UBS during the global financial crisis.

It received significant support in the lower house, with 120 votes in favour, 55 against, and 18 abstentions.

However, despite the lower house’s endorsement, the Swiss government, which is set to present its recommendations for managing banks deemed “too big to fail,” has proposed rejecting the motion.

The government’s stance suggests a divergence in opinion regarding the most effective means of ensuring financial stability and accountability within the banking sector.