Rates on U.S. government debt experienced an upward trend on Monday, marking a shift in the financial landscape. This surge in rates set the stage for a crucial event later in the week—the release of the consumer-price index (CPI) report for February.

The driving force behind the rise in yields was the anticipation surrounding the upcoming CPI data, scheduled for release on Tuesday, 12th March 2024.

Traders and investors eagerly awaited insights into the economic climate, with expectations centring around a 0.4% gain in consumer prices. Furthermore, analysts forecast a 0.3% increase in categories excluding food and energy.

This data carries significant weight, as it has the potential to influence market sentiment and, in particular, impact the Federal Reserve’s decisions regarding interest rates.

When to Expect Results:

With the market eagerly anticipating the CPI report, all eyes are set on Tuesday, 12th March 2024, for a comprehensive understanding of the economic landscape in February.

The potential outcomes of the report, especially if it surpasses expectations, hold the key to the timing of the first interest-rate cut from the Federal Reserve.

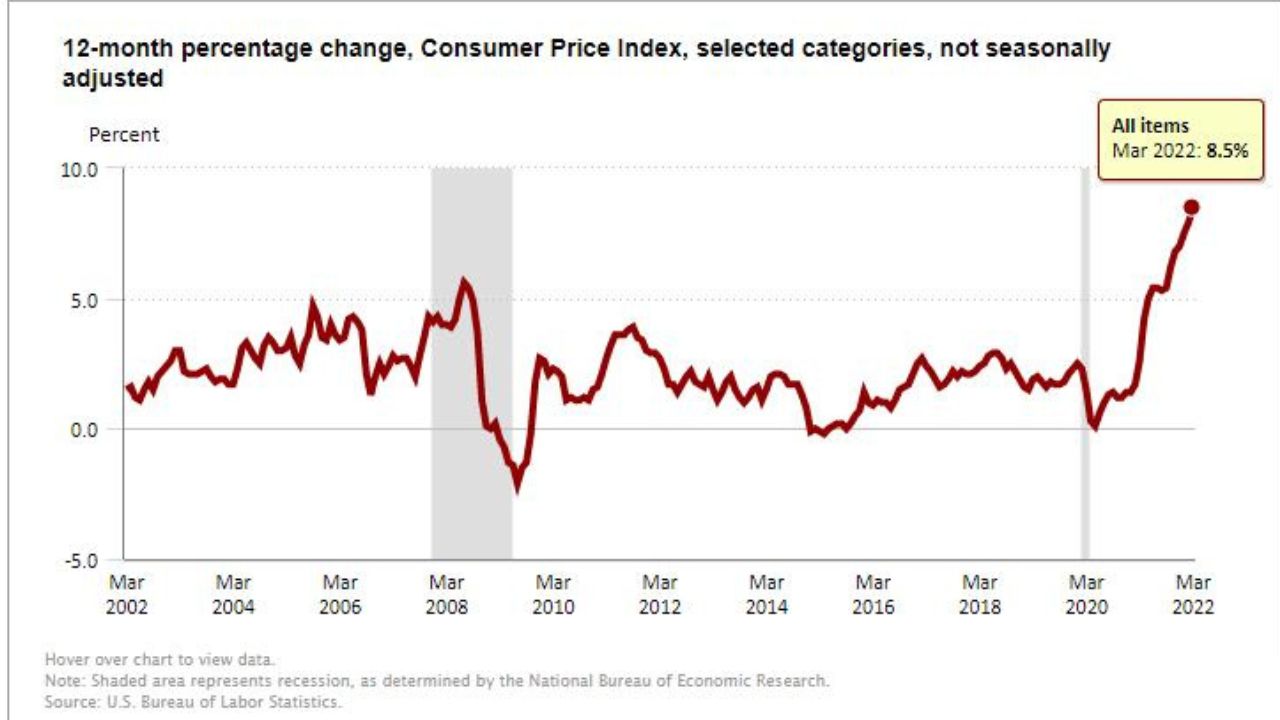

The Consumer Price Index (CPI) is a crucial economic indicator, serving as a barometer for inflationary pressures.

It gauges the average change over time in the prices paid by urban consumers for a basket of goods and services. As a result, the CPI report provides valuable insights into the cost of living, guiding economic policies and market expectations.

Potential Impact on Interest Rates:

The focus on the CPI report is not merely speculative; it holds tangible consequences for the Federal Reserve’s decisions on interest rates.

Should the inflation data exceed expectations, it could potentially delay the anticipated timeline for the first interest-rate cut. This, in turn, could have ripple effects throughout the financial markets, influencing borrowing costs, investment strategies, and economic dynamics.

The rise in U.S. government debt rates reflects the cautious stance of investors ahead of the CPI report. As yields increased, traders adjusted their positions, considering the potential impact of higher inflation on the broader market.

This shift in sentiment highlights the interconnected nature of financial markets, where anticipation and reaction play pivotal roles in shaping investment strategies.

Federal Reserve’s Response:

The Federal Reserve closely monitors inflation data as part of its mandate to maintain price stability. A hotter-than-expected CPI report may pose a dilemma for the Fed, forcing a reassessment of its current stance on interest rates.

Any deviation from market expectations could trigger a recalibration of monetary policy, potentially influencing not only short-term interest rates but also long-term economic outlooks.

The surge in U.S. government debt rates on Monday, March 11th 2024, sets the stage for a pivotal moment in the financial landscape—the release of the February CPI report.

Traders and economists alike are on high alert, expecting insights into consumer prices and their potential impact on the Federal Reserve’s decisions regarding interest rates.

The outcomes of this report hold the potential to reshape market dynamics and provide a clearer trajectory for economic policies in the upcoming months.